Numerated is a fast-growing fintech using data to transform how banks and credit unions make decisions. Financial institutions put their data to work using Numerated to make loan origination and account onboarding easy for their staff and clients. Numerated powers digital application and digital lending experiences for more than 130 top commercial banks, including Bremer Bank, Dollar Bank, Eastern Bank, MidFirst Bank, Montecito Bank & Trust, People’s United Bank, Pinnacle Bank, and more. The company was recently recognized as one of 2020’s Top 250 FinTechs by CB Insights, 2020’s Most Innovative Industry Partner by Barlow Research, and 2020’s Best Overall FinTech Software by FinTech Breakthrough.

Numerated

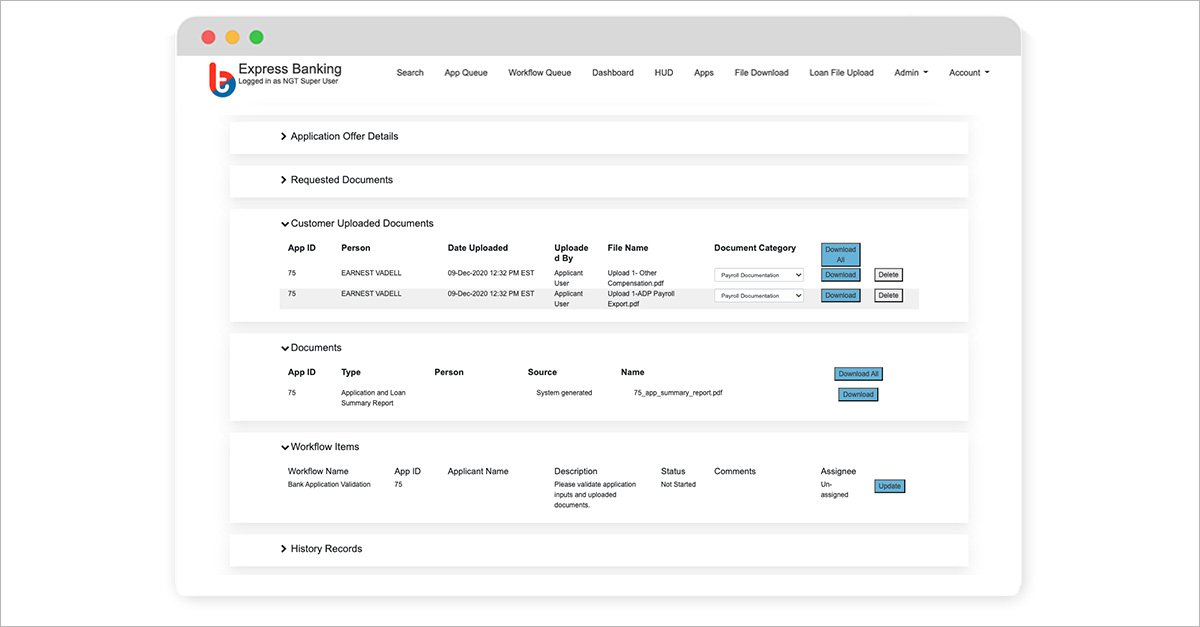

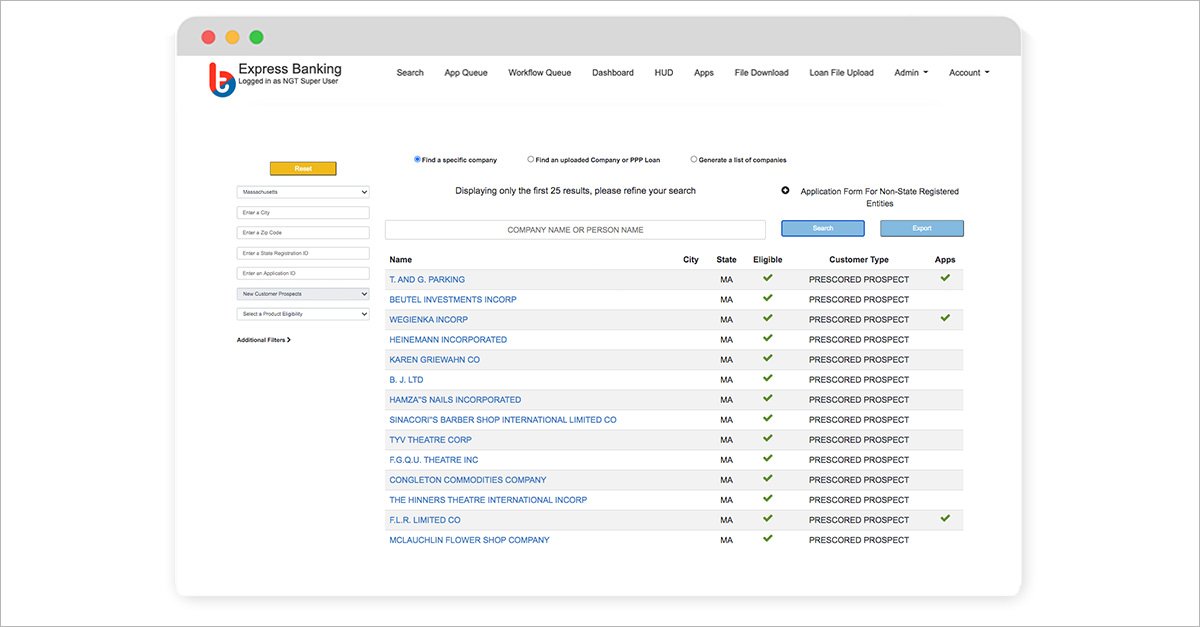

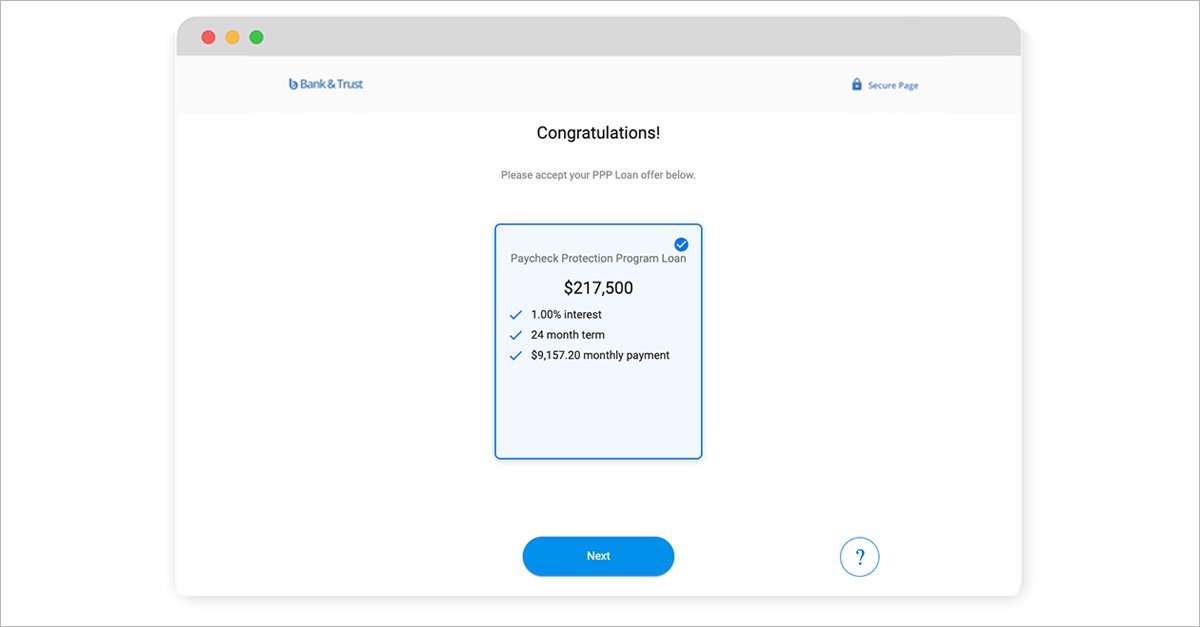

Images

Check Software Images

Customer Reviews

Numerated Reviews

Devon T.

Advanced user of NumeratedWhat do you like best?

Numerated uses multiple data sources to enable quick decisions. They are partnering with the right vendors to automate the end-to-end lending process. The Numerated team really cares about their customers and dig in to provide assistance whenever needed. They are always looking at “what's next” in the digital lending world and how they can solve problems for us.

What do you dislike?

Not a dislike, more a desire for future enhancement: Would love more bank level control over credit matrix.

What problems are you solving with the product? What benefits have you realized?

Numerated allows us to scale - we can automate as much as desired while continuing to offer banker led applications when we choose. We can now serve customers 24/7 and respond quickly with recommended decisions or hold for further review. Numerated has steadily improved their product offering since 2018 and are amazing partners in PPP lending as well as conventional lending.