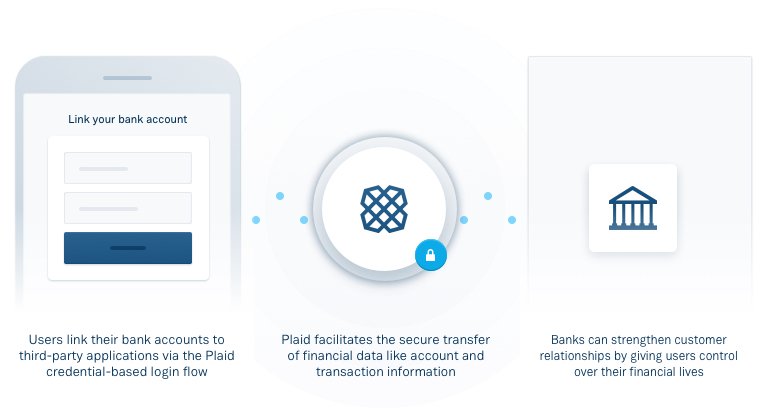

Plaid is a platform with a suite of products that enables developers to build financial applications which can interact with bank accounts, execute payments, and manage risk. It allows a user to easily authenticate and link their bank account to any application and utilize bank-like functionality out of that app. With Plaid, you will be able to develop applications that sync with users’ bank accounts to track and manage their budgets, and transfer funds.

Essentially, it serves as the link between banks and financial technologies. Several noted brands like Gusto, Venmo, TransferWise, Charity Water, Robinhood, and Level Money currently use Plaid’s products and solutions. In the case of popular integrated online HR service Gusto, it uses Plaid’s automated clearing house (ACH) functionality to power its payroll direct deposit service. Other fintechs such as budgeting app Level Money utilize the platform to consolidate and clean data from user’s various bank accounts to help them manage and budget their money.

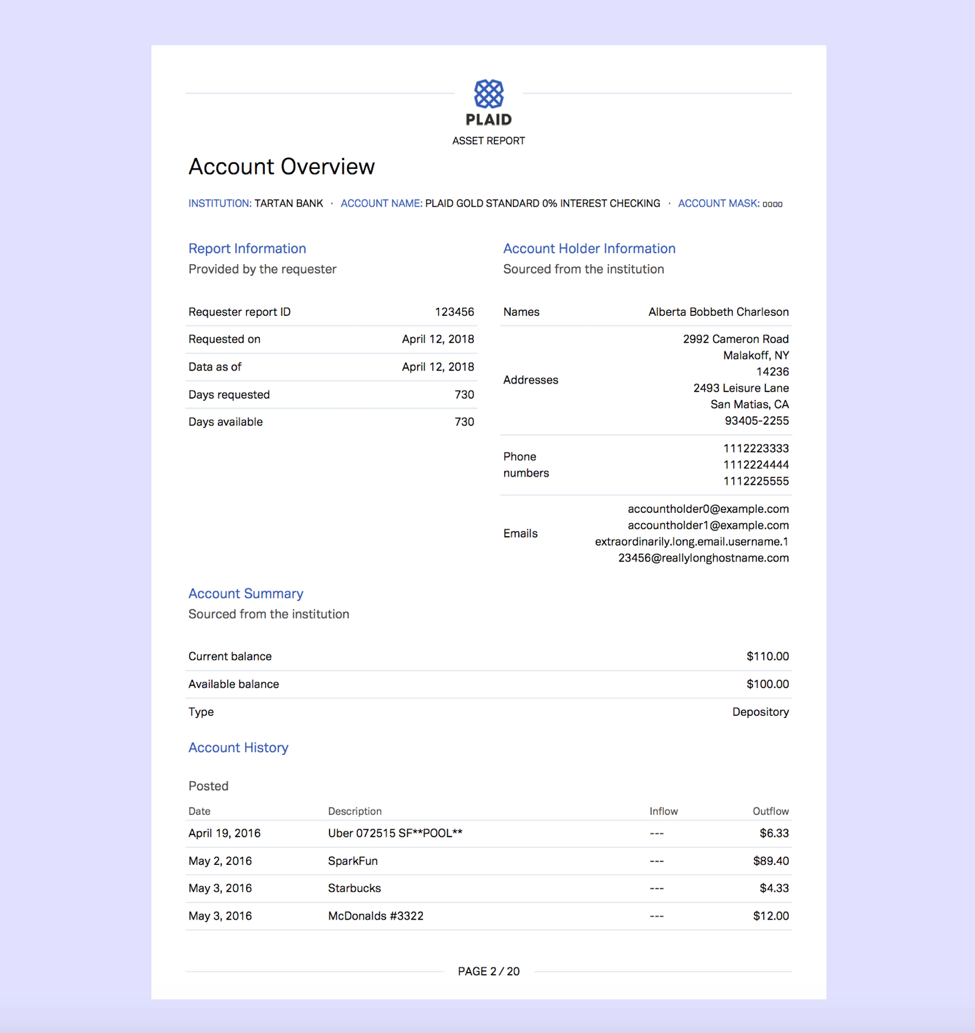

In a broad sense, Plaid spans critical segments of financial services including setting up payments and validating financial data. It can help you arrange and execute ACH payments, collect transaction data, validate user’s identity, examine employment and income data, assess the riskiness of users, and embed bank integrations directly inside borrower flows. Developing your own application has never been made easier – with just a few lines of code, you can fit Plaid into whatever you’re building.

Overview of the Plaid benefits:

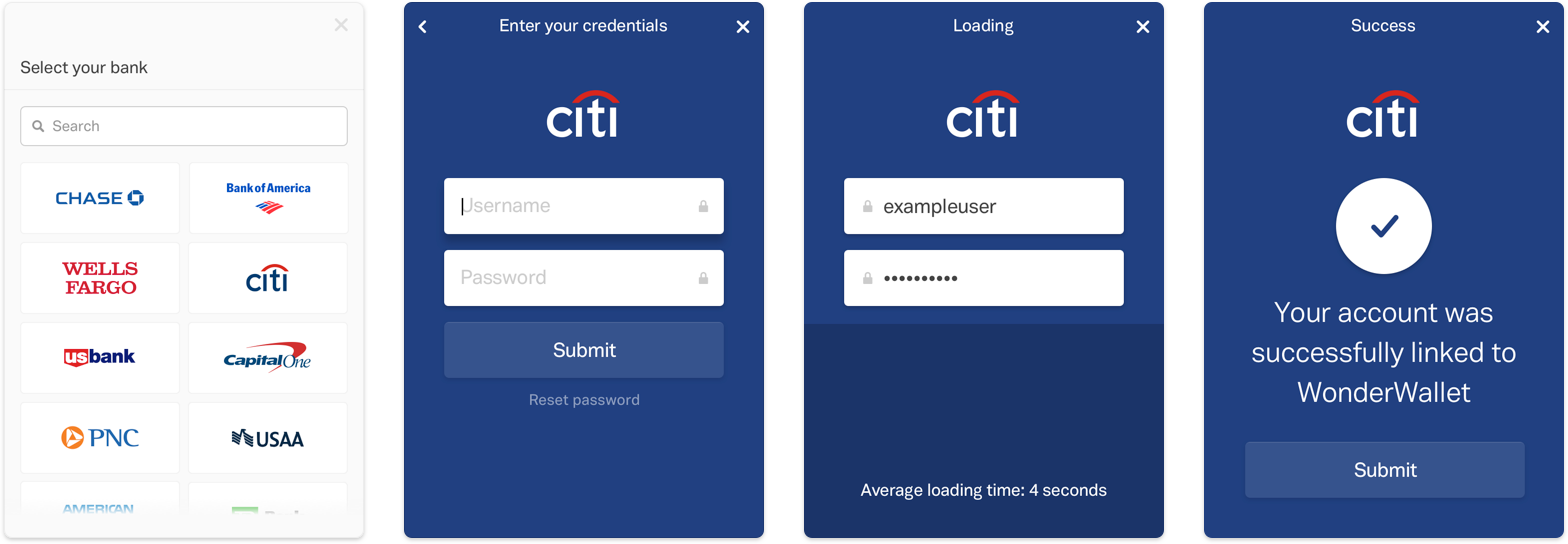

Better ACH authentication

Authenticating accounts for bank-to-bank payments is made simpler, faster, and more user-friendly. You’ll be able to instantly authenticate transfers without waiting for micro-deposits as well as reduce failed transactions by authenticating and steering users toward ACH. This results in a seamless user experience since you can set up users based on information they already know, effectively eliminating checkbook hunting. It likewise boosts conversions by letting you deploy a mobile-optimized flow that converts much better.

Check balances in real-time

Working with financial data is simplified with Plaid. In just a few steps you can pull historical data and real-time balance, and get current and available balance info and details about account status and type. You can check in an instant your users’ balances whenever you need to make a transfer. It helps prevent overdrafts and enables pre-funding of transactions with insight into balances. Furthermore, by gaining visibility into available funds before you transfer, you prevent non-sufficient fund (NSF) fees, thereby, reducing if not outright eliminating fraud cost.

Curtail bank fraud

Plaid enables you to use bank data to verify identities and reduce bank fraud. You can substantiate user identities such as name, phone number, address, and email, and check the information against what’s on file at the bank. You’ll be able to know your users through simple identity check which is further facilitated by auto-fill forms based on account holder info on file with the bank.

Clean & categorized transactions

Money management is streamlined when you get clean, categorized transaction data that goes back as far as 24 months. You’ll have better details about transactions when placed in context with geolocation, merchant, and category information. With reliable, real-time data that stretches as far back as possible, you gain valuable insights to serve your customers better and reduce cost with low-latency connections that don’t require additional technical resources.

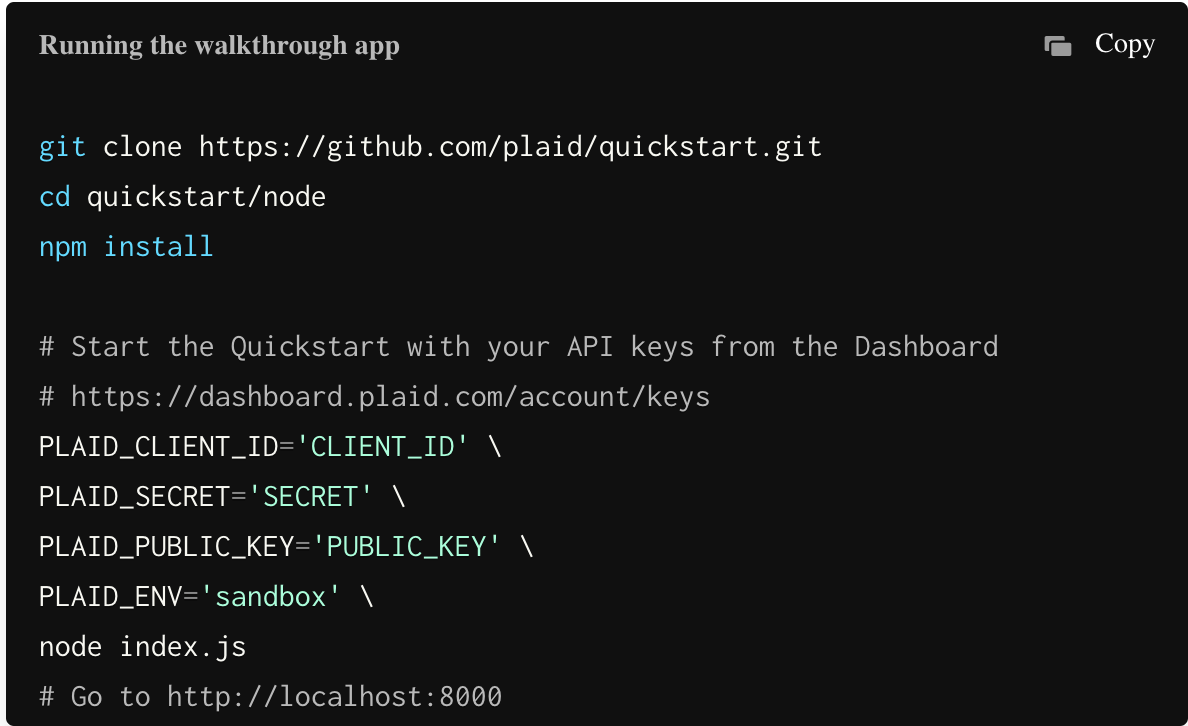

Verify borrower assets straight from the source

Borrowers can link their bank accounts in seconds to maximize conversions. You get fast processing speeds with a integrated technology that seamlessly connects Plaid into your own experience to reduce friction for borrower. Also expediting connections is the commitment to security such as the use of enterprise-grade 256-bit AES encryption that comes with regular network penetration tests and security reviews.