FISCAL Technologies works with companies to prevent working capital leakage and to identify cashflow that can be returned to the bottom line.

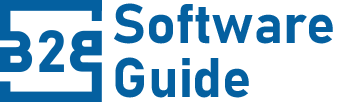

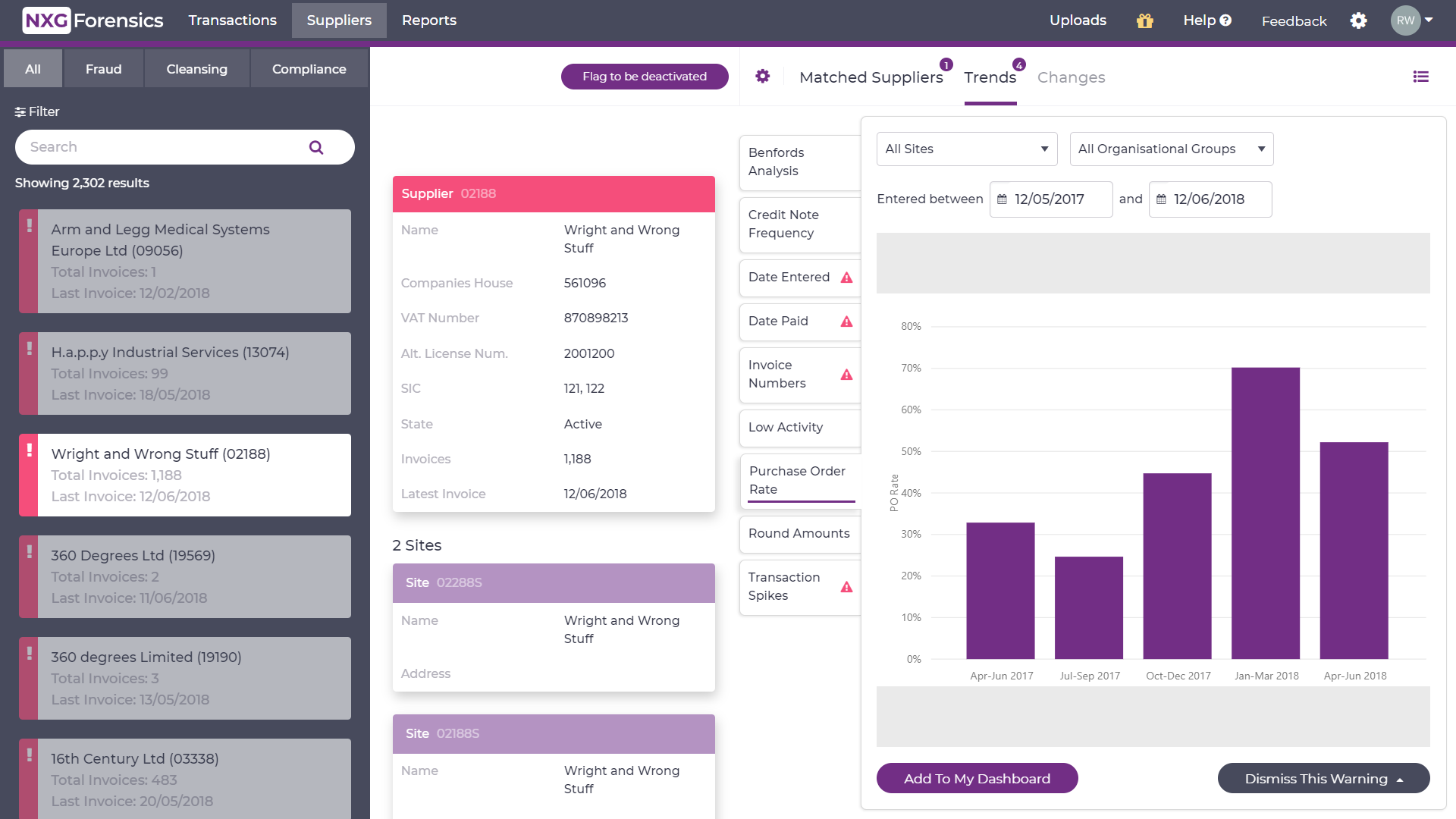

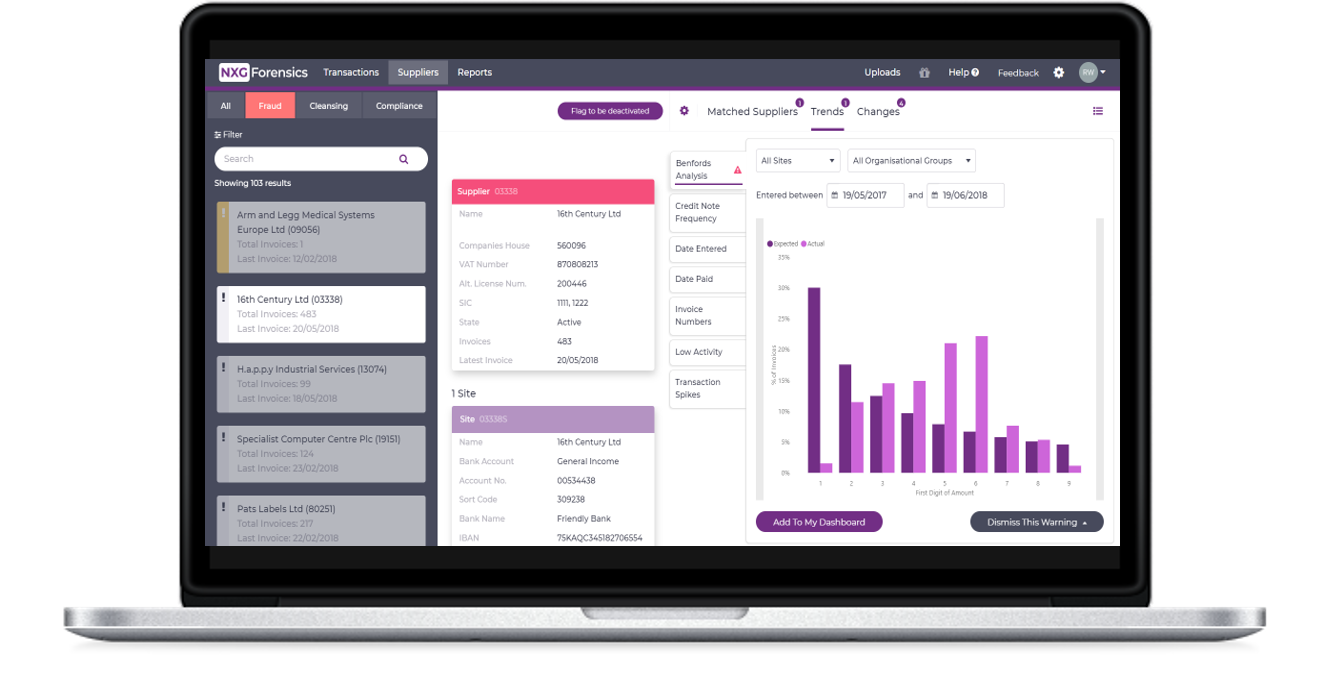

NXG ForensicsВ® – and legacy solution AP ForensicsВ® – are proven AI-powered solutions that transform how companies manage their spend risk prior to payment – regardless of where it resides.

Integrating with any ERP system, NXG Forensics/AP Forensics conducts a daily forensic audit on your P2P system to identify the root cause of payment errors and potential fraud that would otherwise slip through standard methods of financial control – such as three-way matching and no PO no pay.

Once implemented, NXG Forensics /AP Forensics delivers better spend decisions, error prevention, improved policies, elimination of cash leakage, and maximises audit efficiency company-wide.

Contact us to learn more: [email protected]

вђпёЏCaroline A.

Advanced user of FISCAL Technologies

★★★★★

Great product, great support and a product that compliments the controls

What do you like best?

By running the duplicate/error checking on transactions prior to any payment run, we are confident that no rogue transactions will get paid, and more importantly the cash stays in our Bank Account. #Prevention vs #Recovery

What do you dislike?

I am struggling to think of anything I dislike about Fiscal Technologies

Recommendations to others considering the product:

Take the FD or CFO through the challenges of processing invoices and the expected error rate in cash terms. Every data entry process is susceptible to errors which translates into cash exiting the business unnecessarily. Amend your processes to run the validation prior to any payment run and prevent rather than recover errors. Fiscals functionality is great and the Customer Care and support throughout your journey. Cloud product which doesn't interfere with BAU, it compliments it

What problems are you solving with the product? What benefits have you realized?

Identifying processing errors. Investigating spike transactions. Ensuring that all transactions are validated prior to paying. Investment was paid back within 1 1/2 hours of going live with the product

Review source: G2.com