With Advantage Fixed Assets from Bloomberg Tax & Accounting, you gain accuracy and control to empower better decisions, optimize tax savings, shorten financial close times, and respond to change faster. Powered by the Advantage platform and equipped with flexible integration capabilities, Fixed Assets makes it easy to expertly manage the largest expenditures on your company’s balance sheet with efficiency and confidence.

Bloomberg Tax & Accounting Fixed Assets

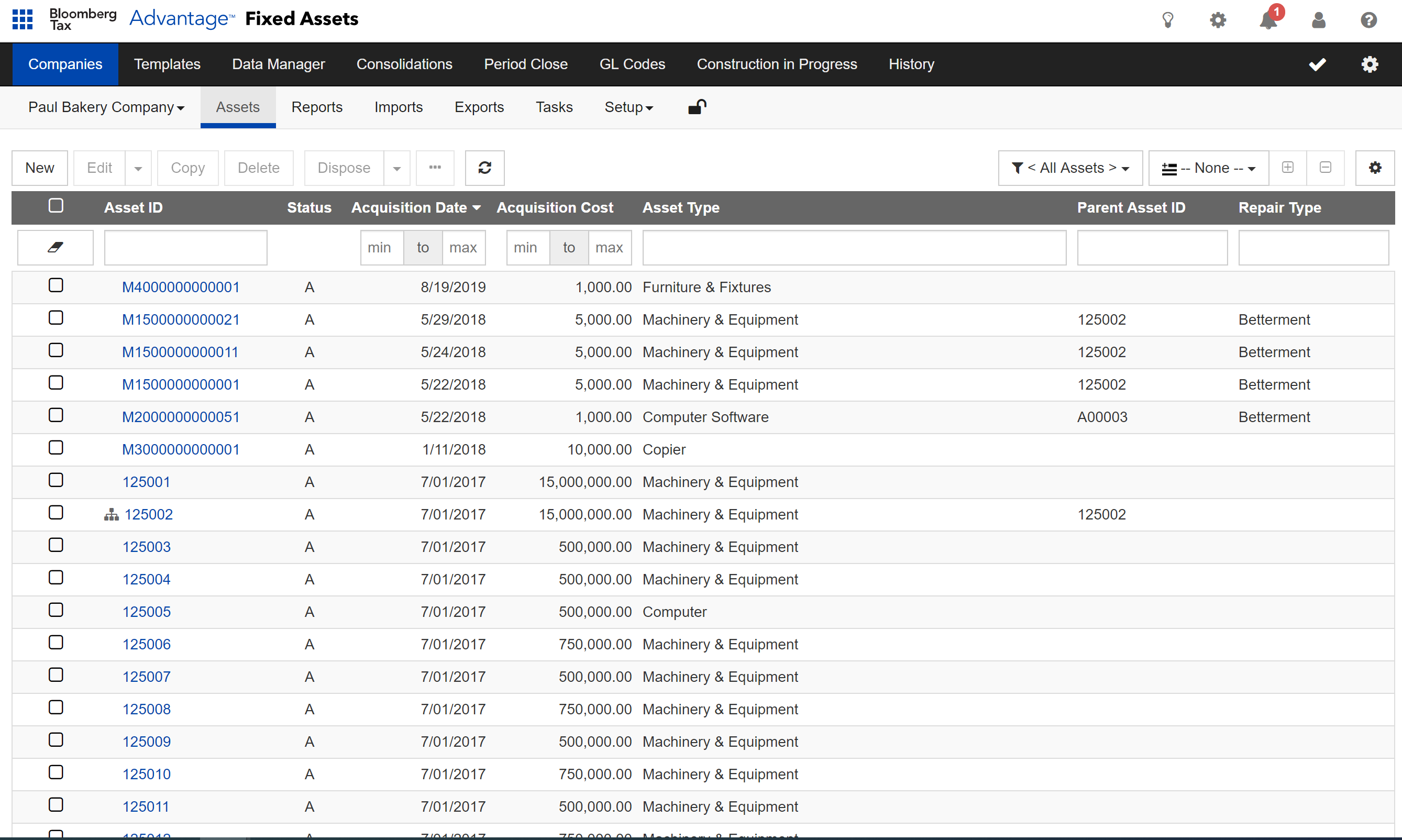

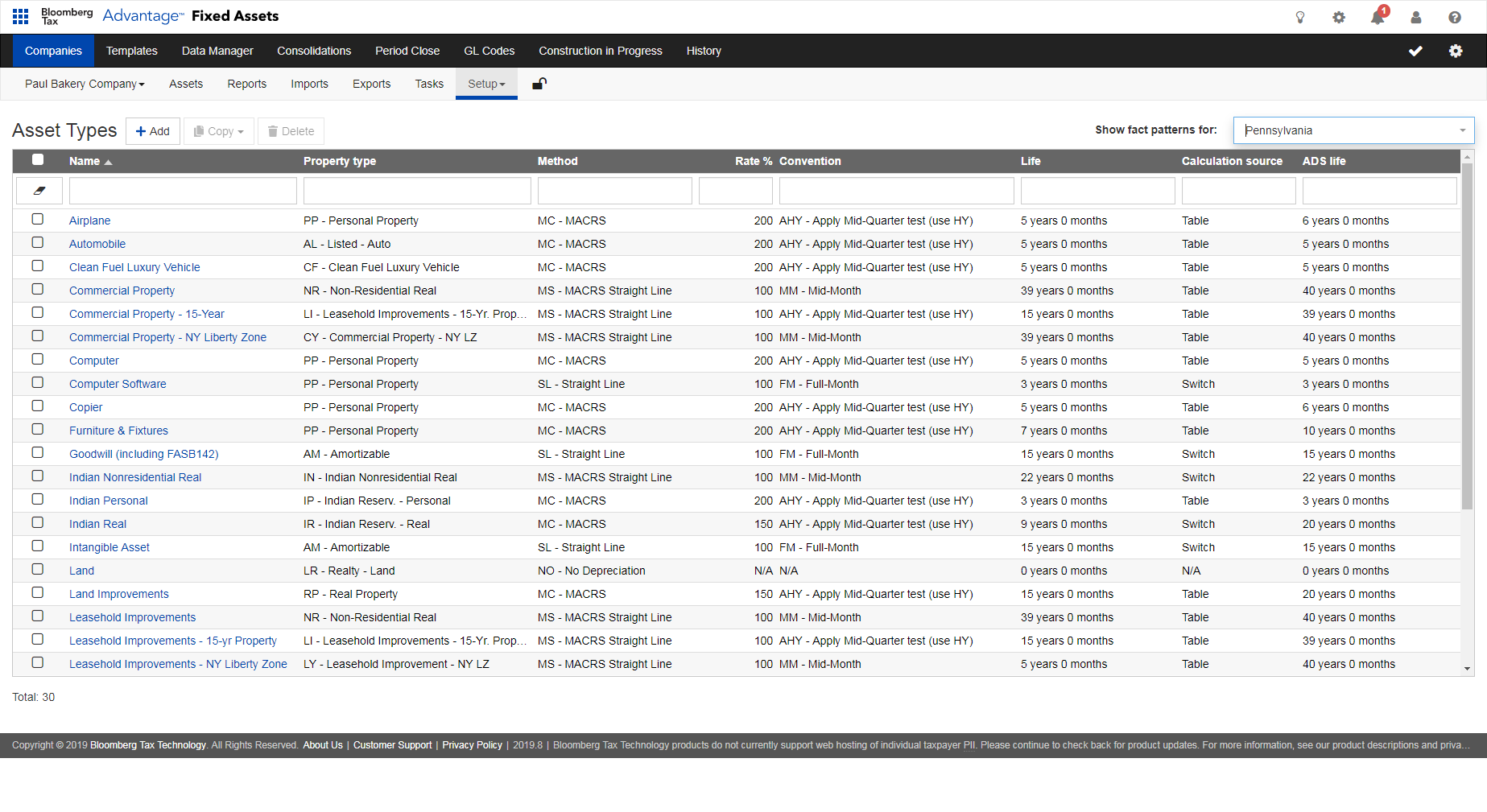

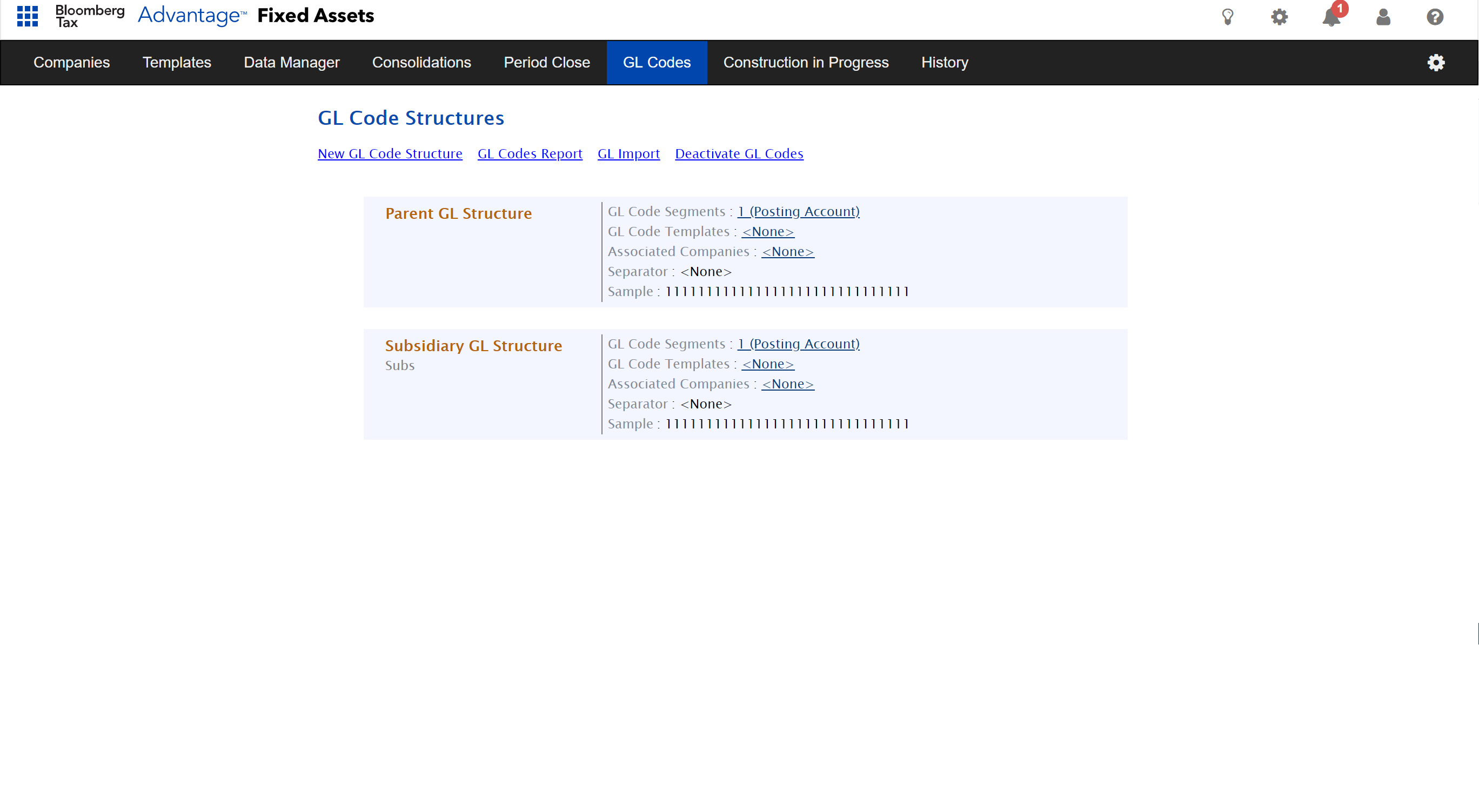

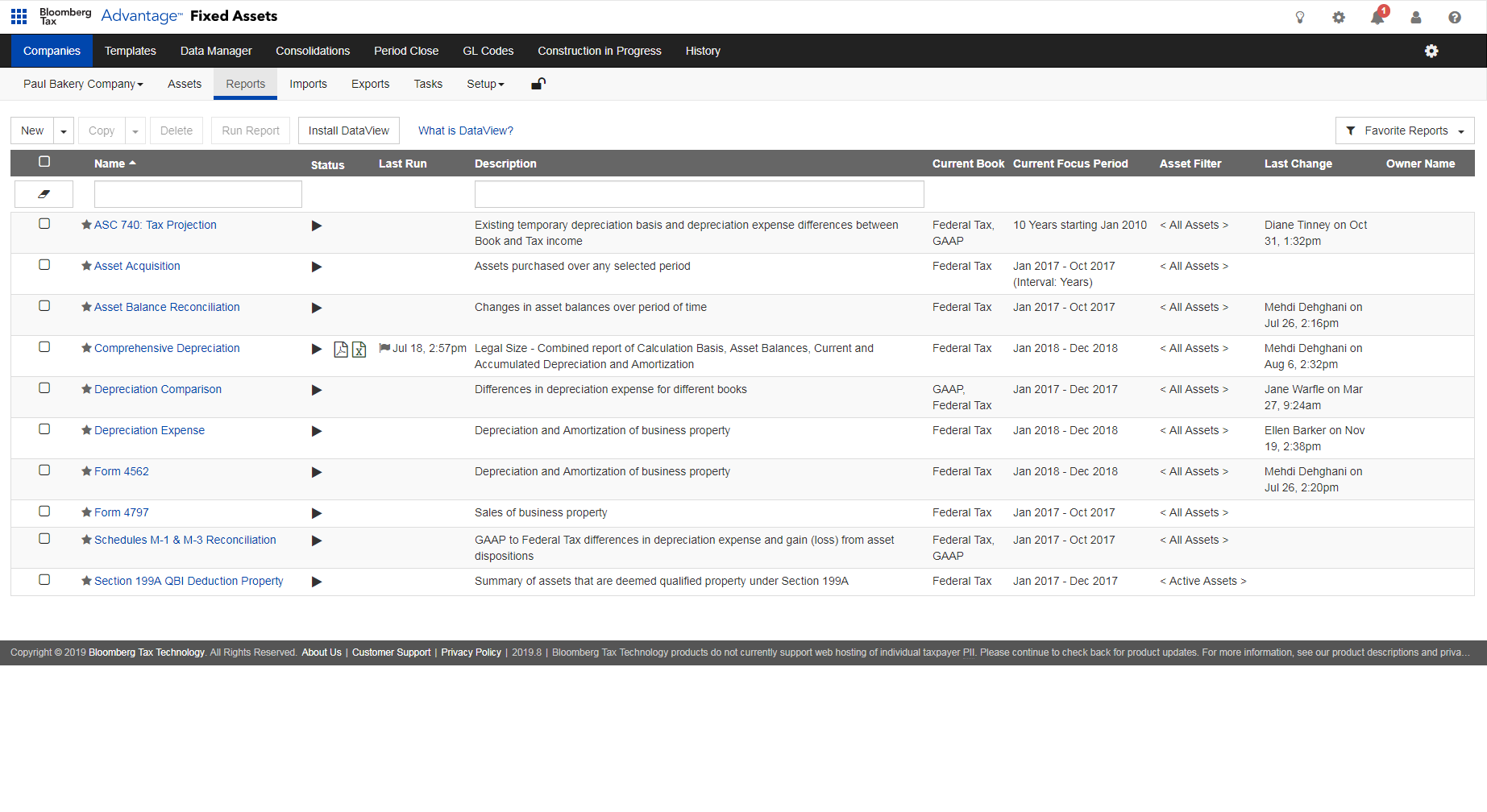

Bloomberg Tax & Accounting Fixed Assets is a fixed asset management and depreciation software that allows you to manage the fixed assets lifecycle from construction and purchase through retirement.

7.8/10

(Expert Score)

★★★★★

Product is rated as #27 in category Corporate Tax Software

Images

Check Software Images

Bloomberg Tax & Accounting Fixed Assets

Customer Reviews

Bloomberg Tax & Accounting Fixed Assets Reviews

Sarah W.

Advanced user of Bloomberg Tax & Accounting Fixed Assets★★★★★

What do you like best?

I like that this software keeps track of all fixed assets and makes it easier to apply depreciation rules.

What do you dislike?

The software is very slow to load and freezes at times, I have had issues with AMT depreciation as well.

Recommendations to others considering the product:

I have tried both Sage fixed assets and BNA fixed assets. I can't say one is astoundingly better than the other. They are both slow at times but ultimately make keeping track of fixed assets easier.

What problems are you solving with the product? What benefits have you realized?

Problems solved: time wasted trying to keep track of fixed assets and recreating workbooks

Benefits realized:" more accurate depreciation reports