Designed specifically for financial advisors, SmartRisk helps you set proper downside expectations with your clients. Clients are often blind to market risk and typically don’t have accurate downside expectations – either too conservative or too reckless, leading to sub-optimal investment allocations. With SmartRisk, advisors can analyze portfolio risk and easily communicate with clients to help them avoid costly mistakes.

Move prospects to the planning process and motivate clients to make portfolio changes with SmartRisk. Retain clients during a down market and help prevent clients from making costly behavioral mistakes. Showcase and market your expertise to clients.

Core features:

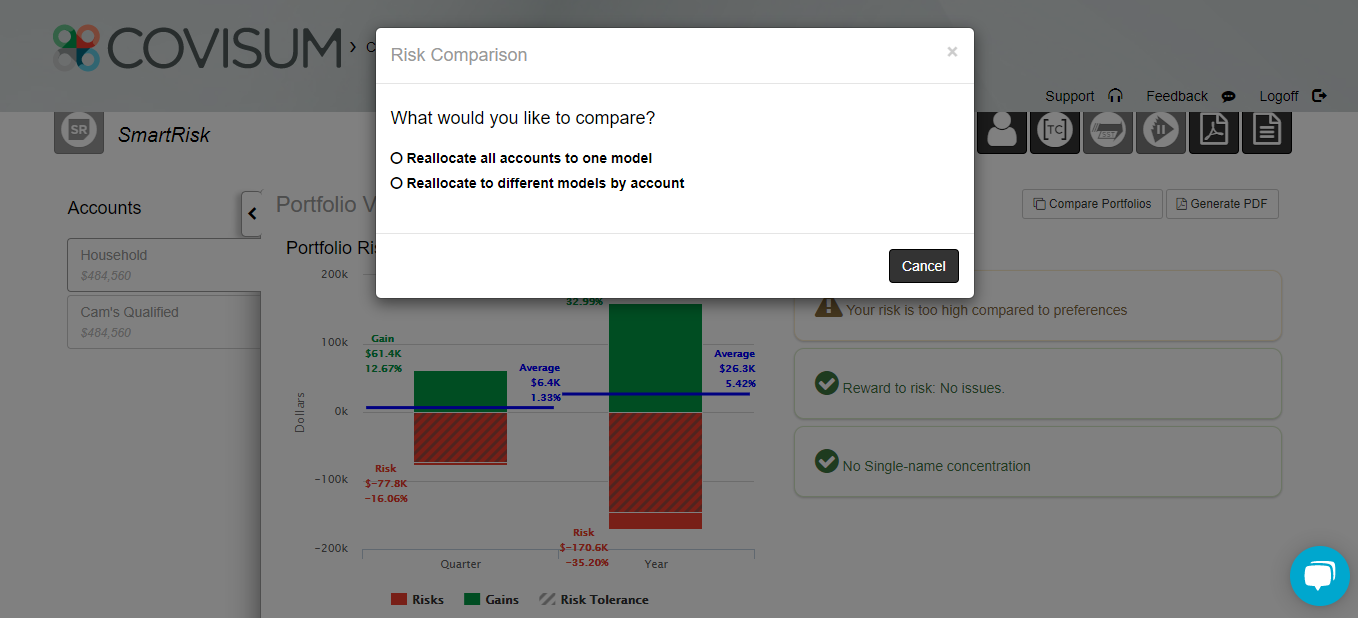

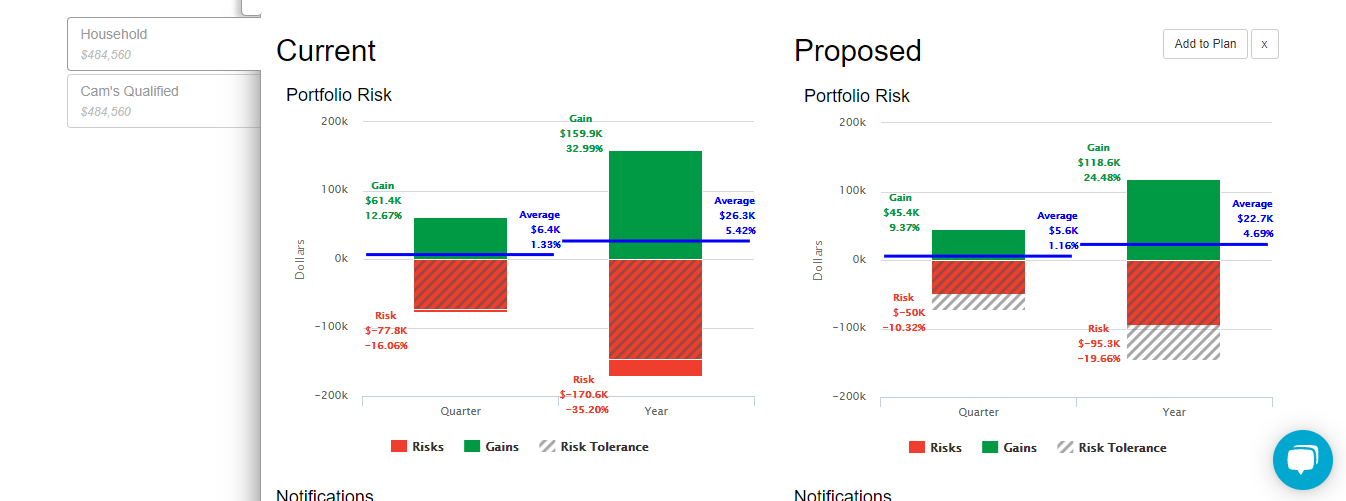

-Portfolio comparison

-Single name concentration alerts

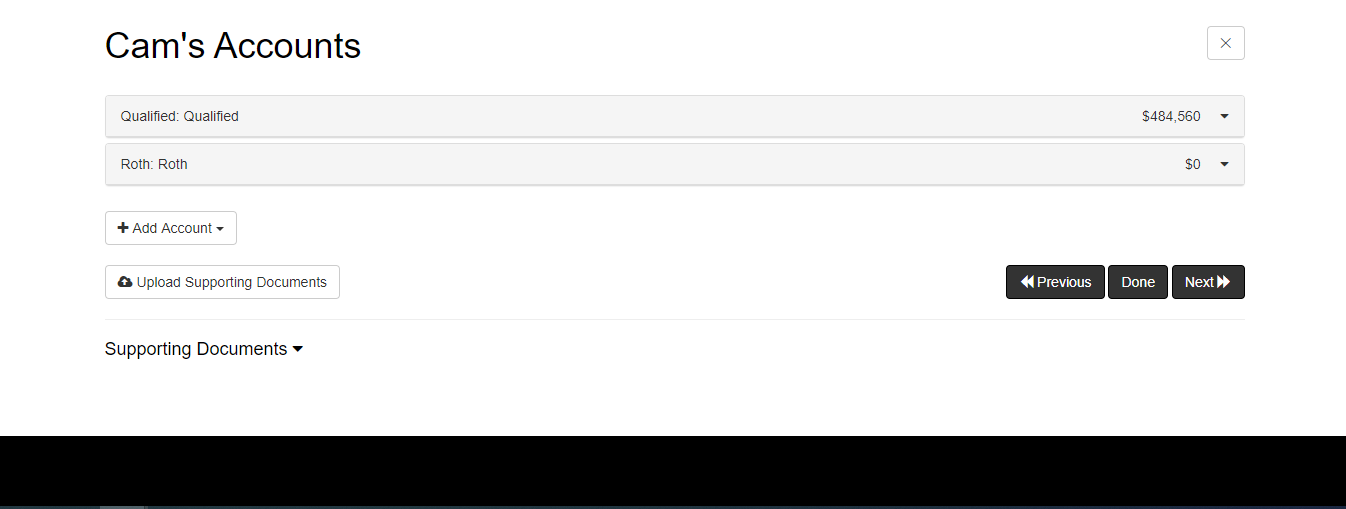

-Household views of accounts

-Explain risk to clients in terms they can understand — dollars

-Set proper downside expectations

-Marketing tools, including a client-facing seminar, brochure, and direct mailer

-Access to awesome support, industry expertise and training