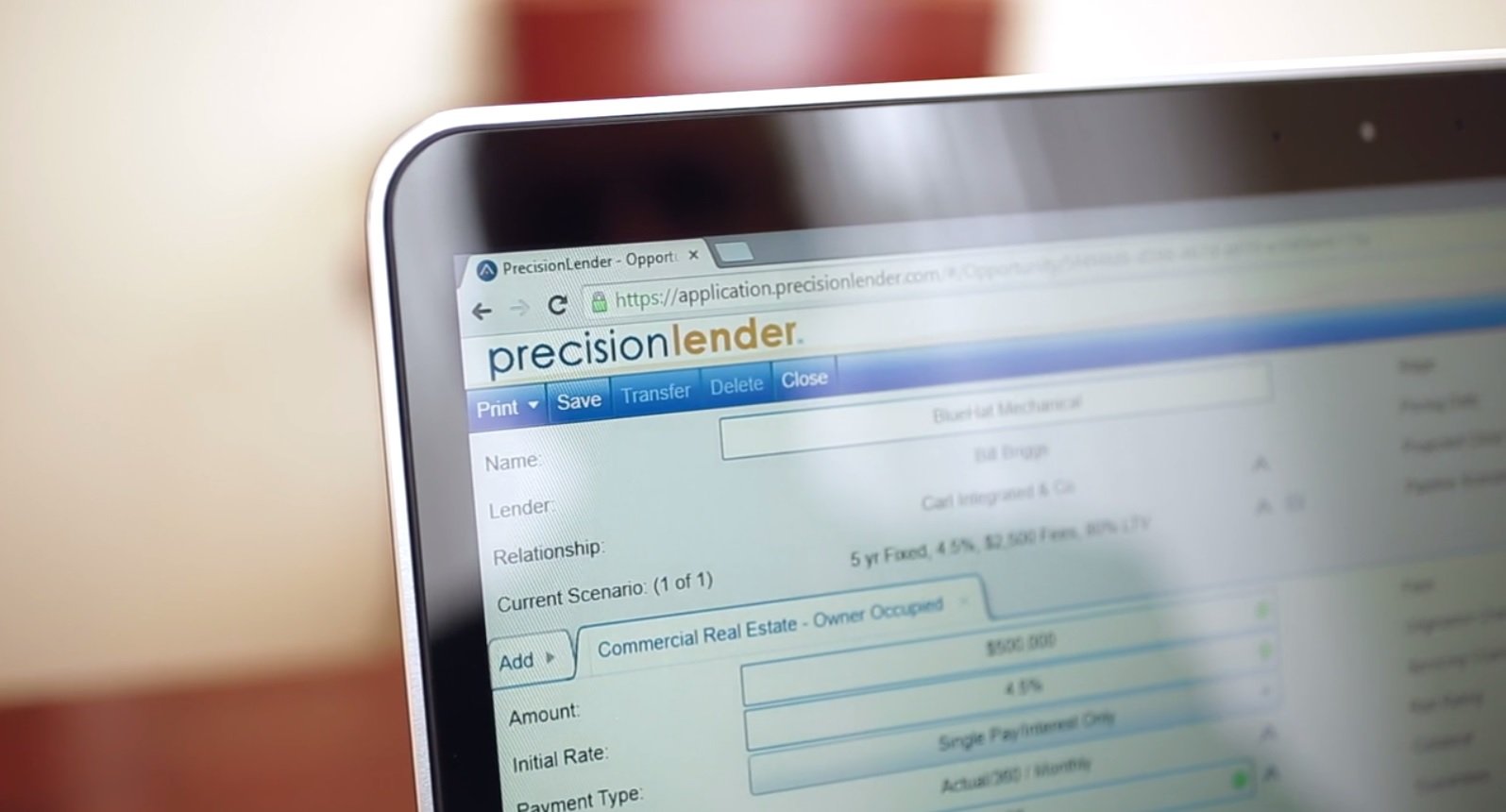

PrecisionLender, a Q2 company, is modernizing commercial banking. Its sales and coaching platform empowers bankers with actionable, in-the-moment insights, so they win better deals and build strong, more profitable relationships. AndiВ®, PrecisionLender’s digital enterprise coach, augments banker strengths and intelligence with the latest technology and data, delivering the best recommendations at exactly the right time. 13,000+ bankers at approximately 150 banks—ranging from under $1B to over $1T in assets—use PrecisionLender’s solution. Set your bank apart with PrecisionLender’s applied banking insights. Visit https://precisionlender.com to learn more.

PrecisionLender

Images

Check Software Images

Customer Reviews

PrecisionLender Reviews

User in Investment Banking

Advanced user of PrecisionLenderWhat do you like best?

This is the best product if you want to fuel loan growth and promote competition among bankers within your bank. Not only does this tool help you to price your loans but your deposits as well. For these reasons, I am a huge fan of this tool. Also great is that it lets you know the live feed of rates. So rates like Libor are up to date

What do you dislike?

Sometimes the real time feed of rates cannot be so real time. This is particularly concerning because we are moving away from rates like Libor and banks may need to switch to things like SOFR. It will be interested to see how Precision lender responds to these changes in the market although I am not holding my breath

What problems are you solving with the product? What benefits have you realized?

The ability to price loans with the deposits that back them is the huge trouble we overcome with this tool. It also allows us to map our loans back to the funds transfer pricing that our business gets from our central treasury group at our bank