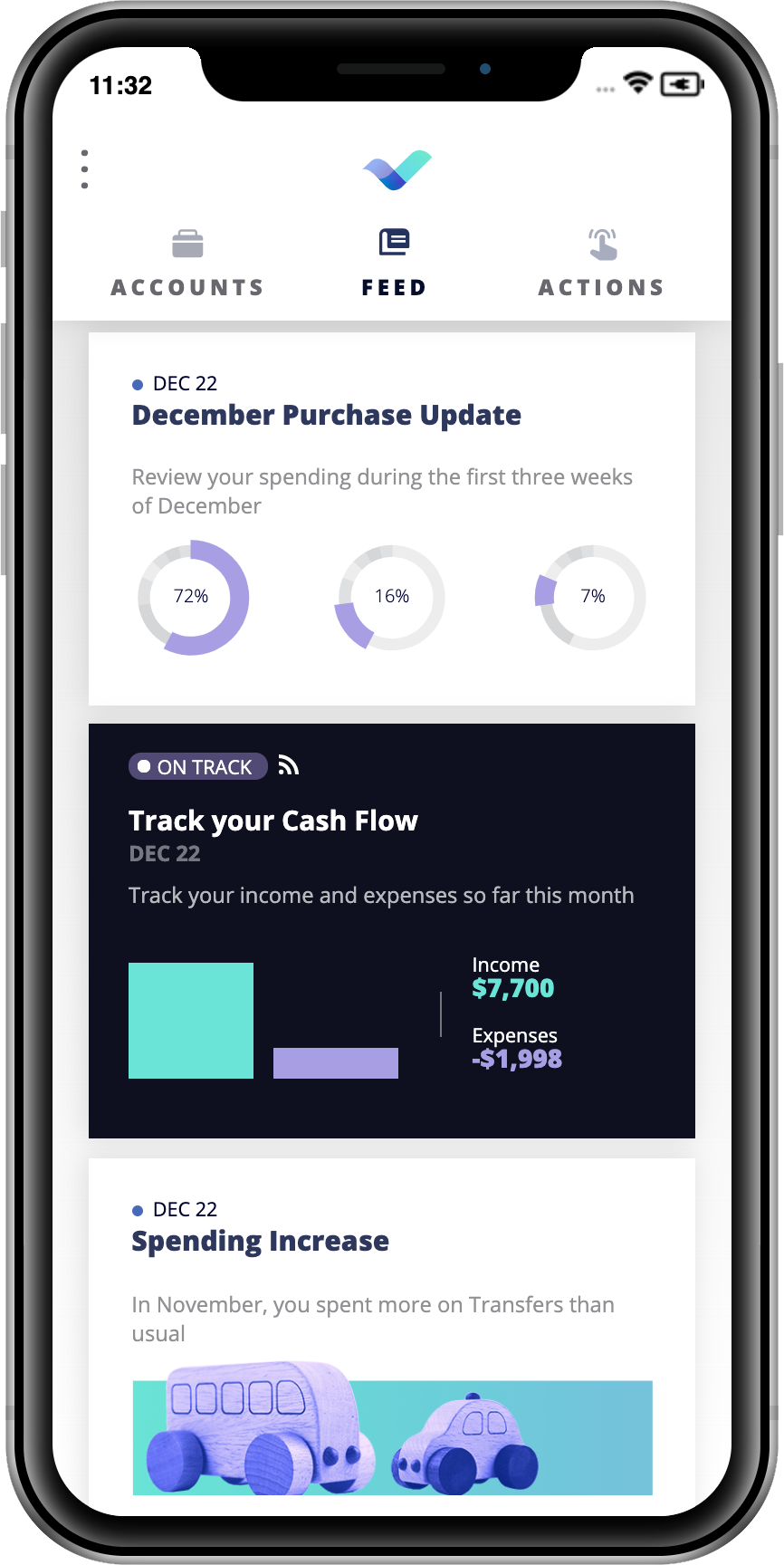

Personetics Engage provides real-time, personalized and proactive Insights and Advice that keep customers engaged and help them stay on top of their finances. Using real-time predictive analytics to empower customers, it’s time banks re-establish themselves as trusted partners.

– Deliver financial-data driven personalized alerts, insights and advice

– Provides standalone bite sized information about a customer’s financial activity and what to focus on right now

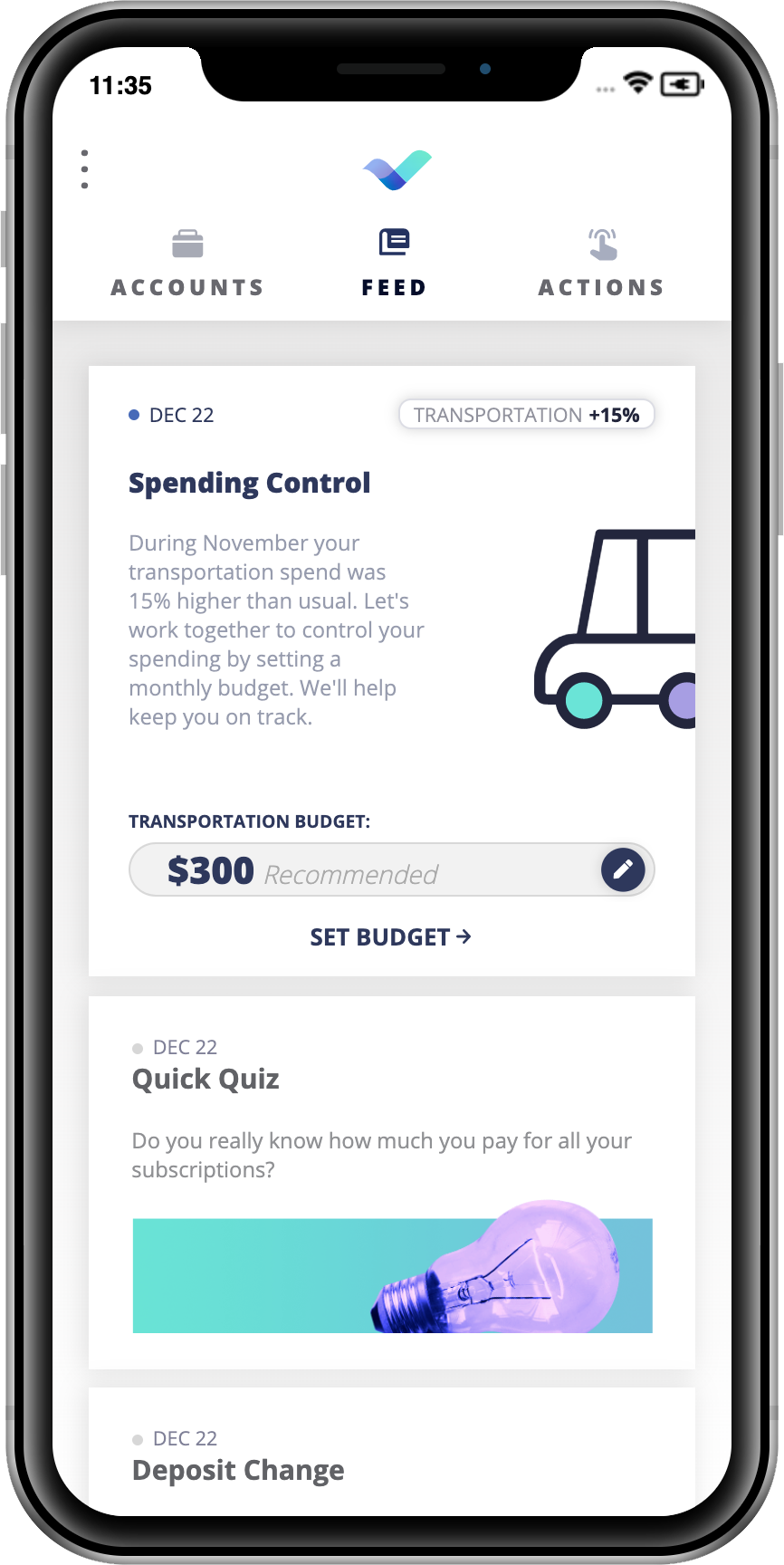

– Assists customers in better managing their financial lives

– Suggest specific steps to increase savings, reduce debt, and improve financial outcomes

– Includes complete server-side support, client widgets and data enrichment catalog

The Right Information for Each Customer at the Right Time

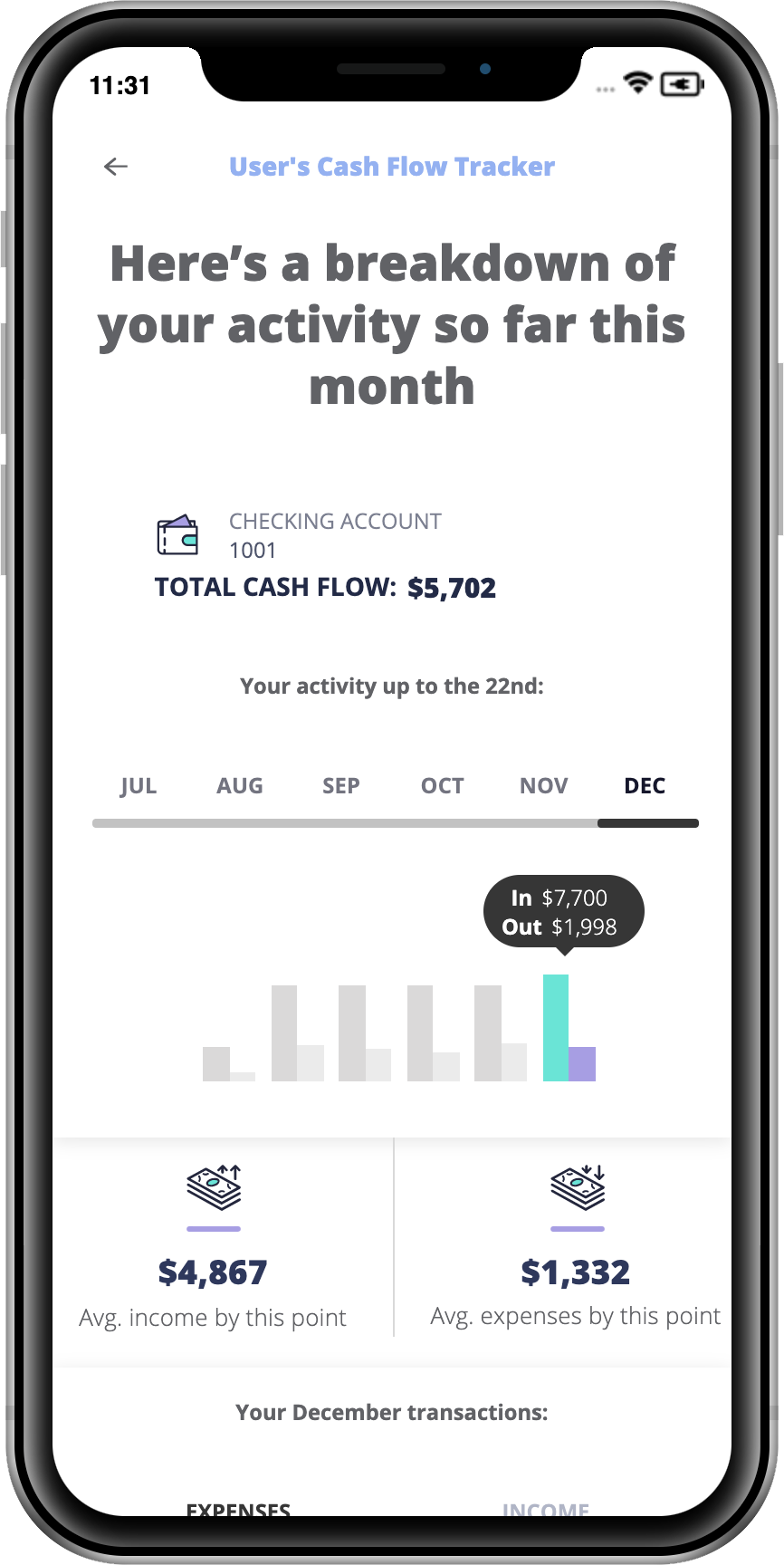

Engage analyzes user-specific transaction data to create personalized actionable insights. To determine the optimal prioritization and display order for each user, we utilize a proprietary learning algorithm that identifies and ranks the most relevant insights at any point in time.

Real-Time Insights

Insights are triggered upon invocation, to ensure they account for the most recent customer activity and reduce false positives. For example, alerting a customer to a low balance issue based on previous night’s batch feed would be inaccurate if the customer had a cleared deposit earlier in the day.

Out-of-the-Box User Insights for Financial Services

Engage comes with a rich library of pre-built user scenarios that include banking-specific triggers and workflows validated with banking customers across the globe, with new insights added on an ongoing basis.

Self-Learning

Over time, Engage learns from individual customer interactions to better select and prioritize insights for each customer. It also supports the ability to capture explicit user feedback (rating, likes, etc.) that is utilized as part of the learning algorithm.

Differentiate by Creating Custom Insights

The Engagement Builder let’s banks quickly and easily create custom content and engaging insights with a codeless management console that speeds up the development cycle and deployment to all bank channels.