Paydit is an online platform for collection companies, lenders, and banks that automates the entire debt resolution process, from payment plan negotiation to status tracking and reporting, enabling cost-efficient and regulatory-compliant alternatives to the traditional debt resolution process.

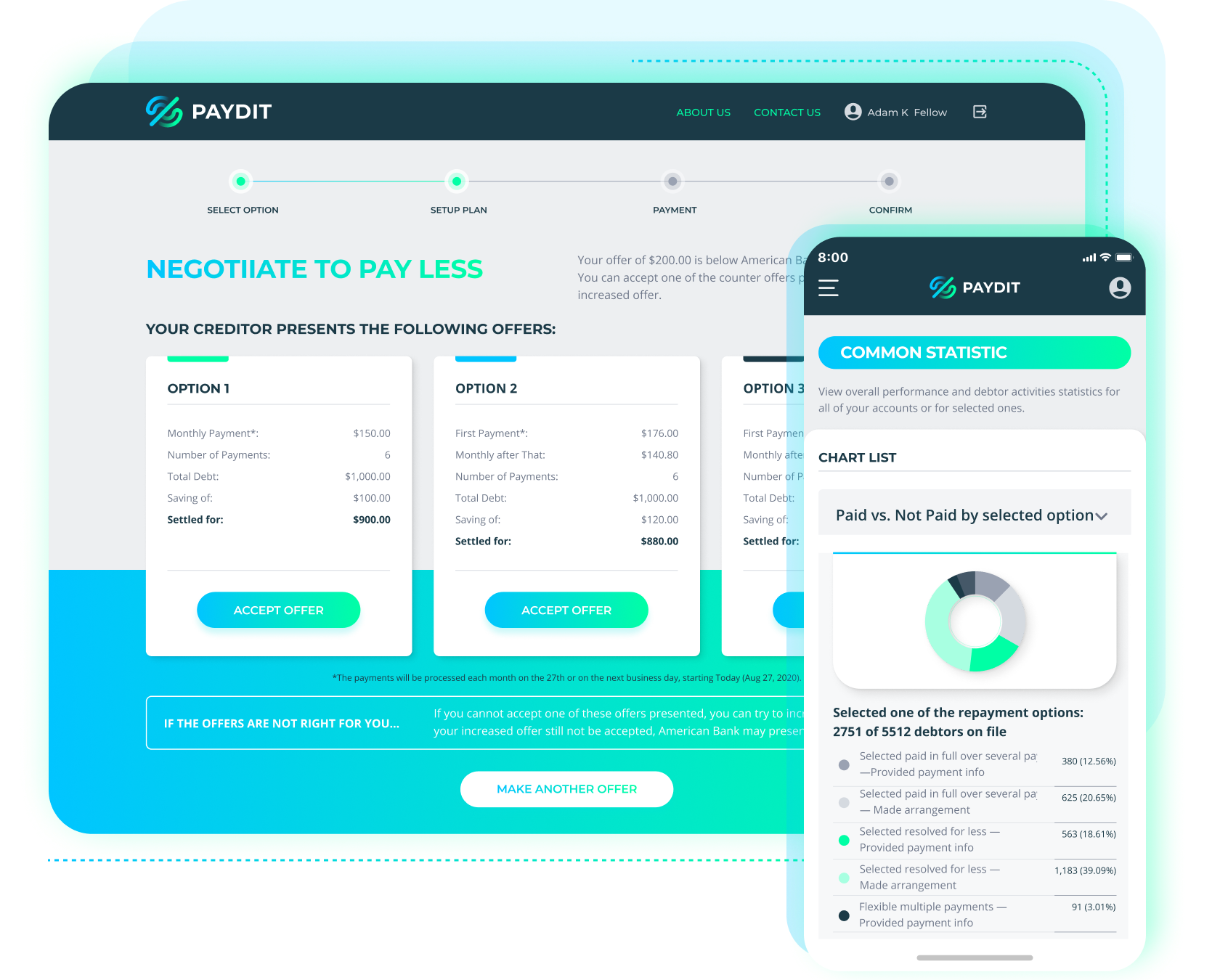

With Paydit, you can adjust every key parameter of debt negotiation and settlement to fit your internal processes and business requirements. These parameters include the number of installments, payment options, billing, and more. As a result, you make the entire workflow more stress-free and convenient.

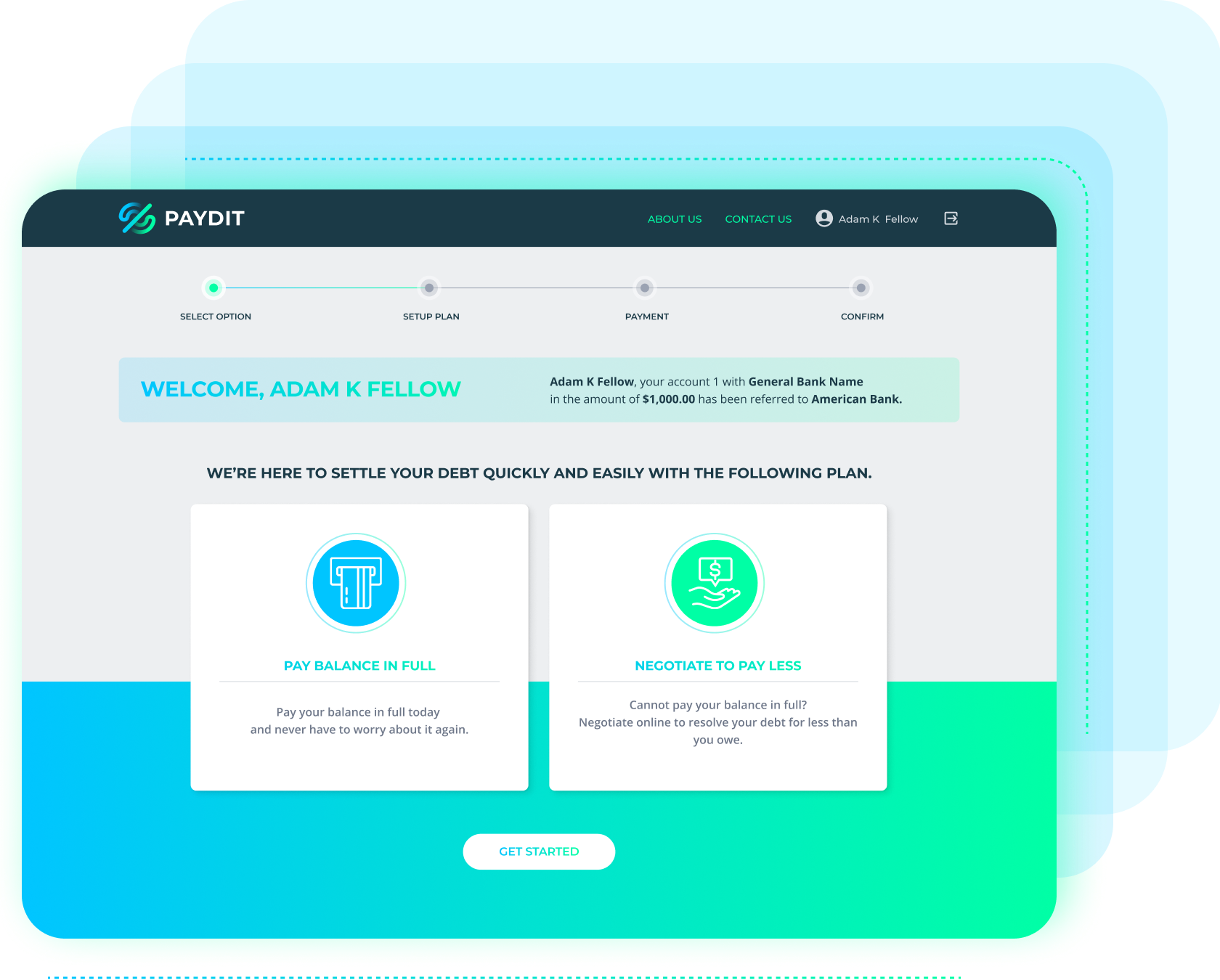

The Variety of Debt Settlement Options

The consumer can choose how to repay the debt, depending on the rules you set and their own preferences.

Pay in full — the consumer makes a one-time payment, settling the debt at once, or repays in installments.

Negotiate to pay less — Paydit offers payment plans through which the consumer can pay a percent from the debt. Alternatively, they can try to renegotiate the amount to pay if none of those is affordable.

Flexible payments — negotiate payment plans for a part of the past-due account or create your own plan that meets the consumer’s budget and schedule.

Secure Debt Settlement

Besides the integrated payment processors, Paydit allows you to add other payment providers that you trust to guarantee secure payments to consumers.

Comprehensive analytics

Assess performance and consumer activities on the go with our detailed reports.

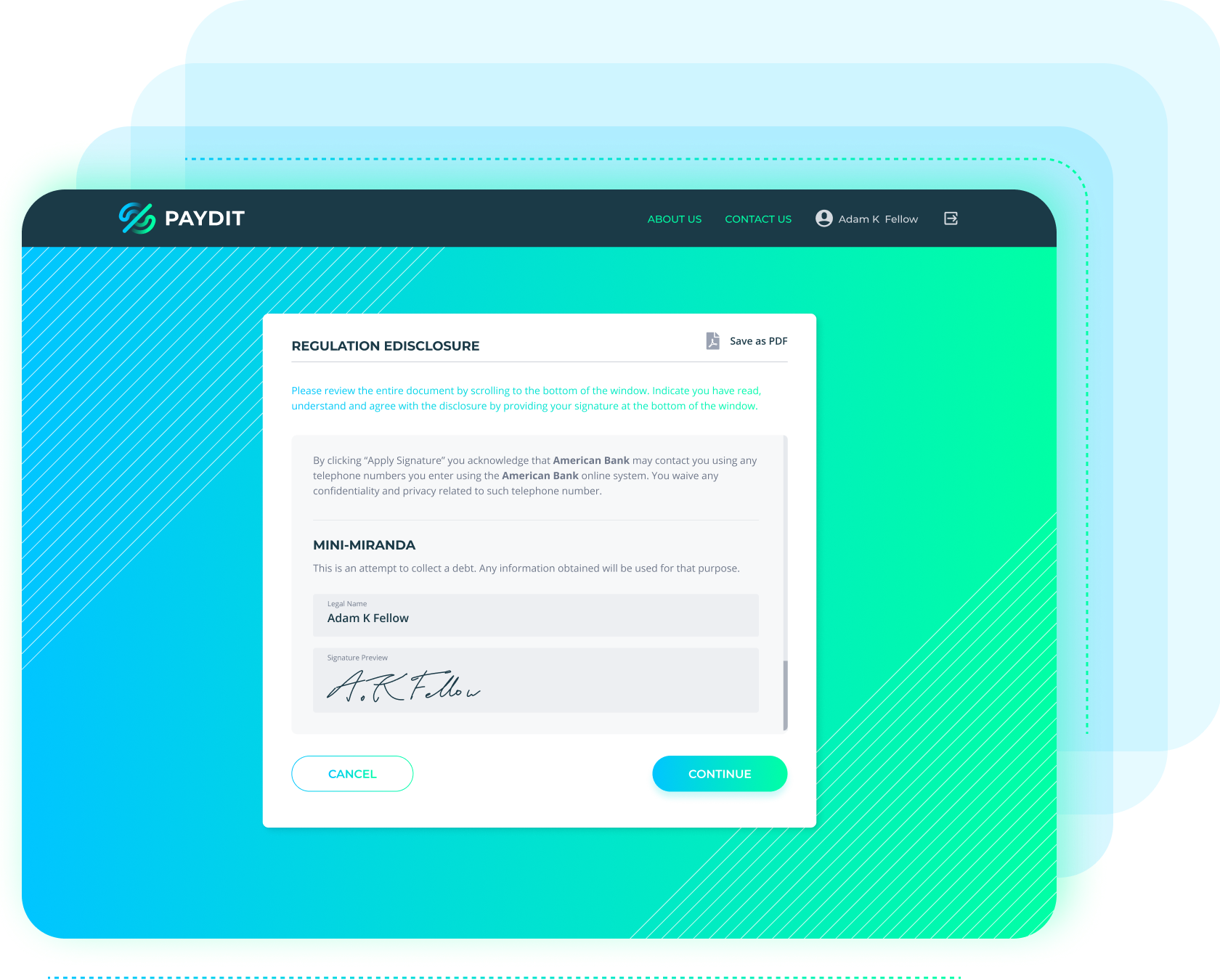

Full compliance

Finally, Paydit is about compliance. The automation algorithms facilitate settling debts while following FDCPA and TCPA. For example, our solution automates legal wording in letters to be sent to consumers, choosing the right time to make calls.

To top it all off, Paydit is easily adjustable to local regulations, ensuring auditable consumer interaction.