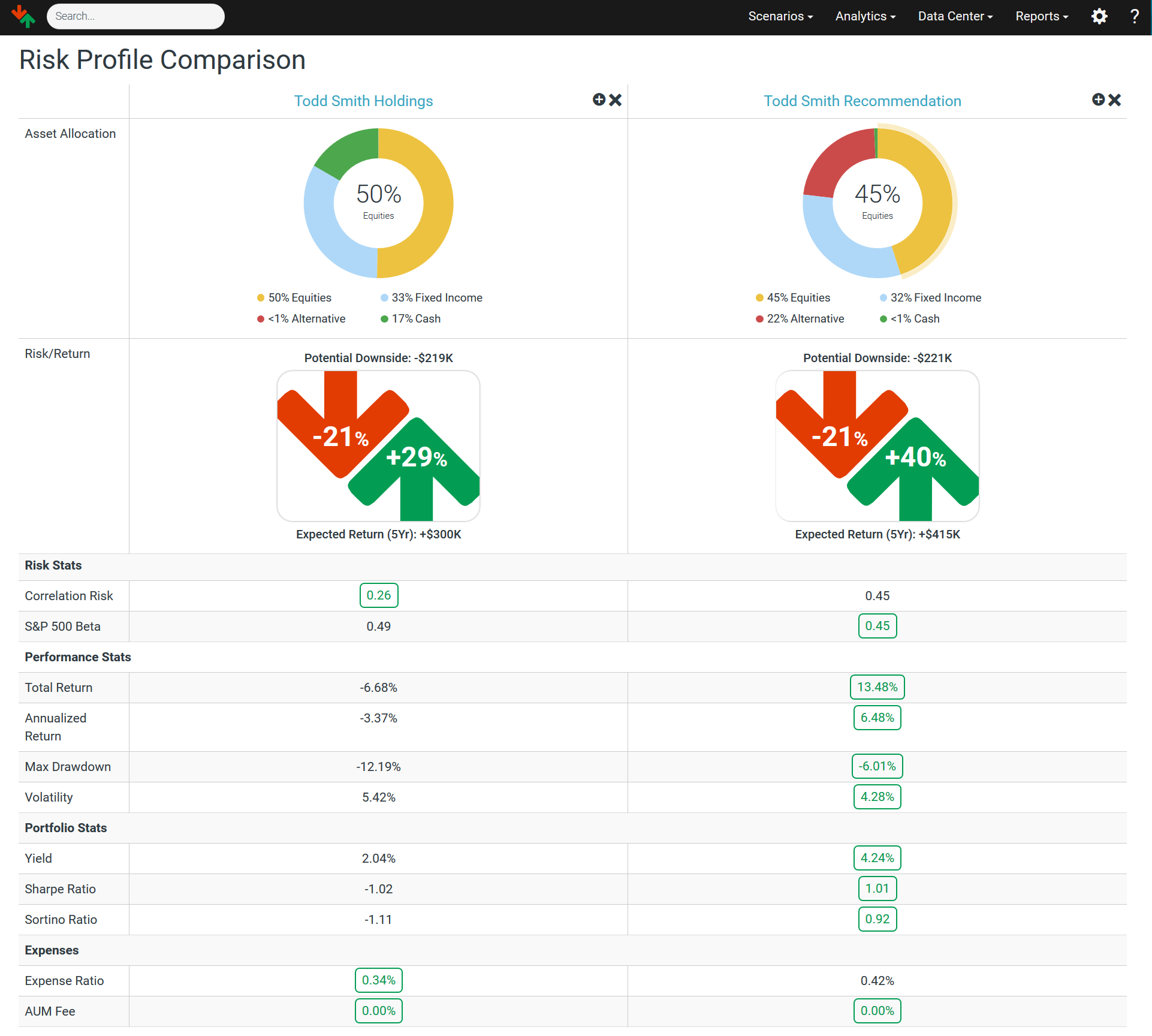

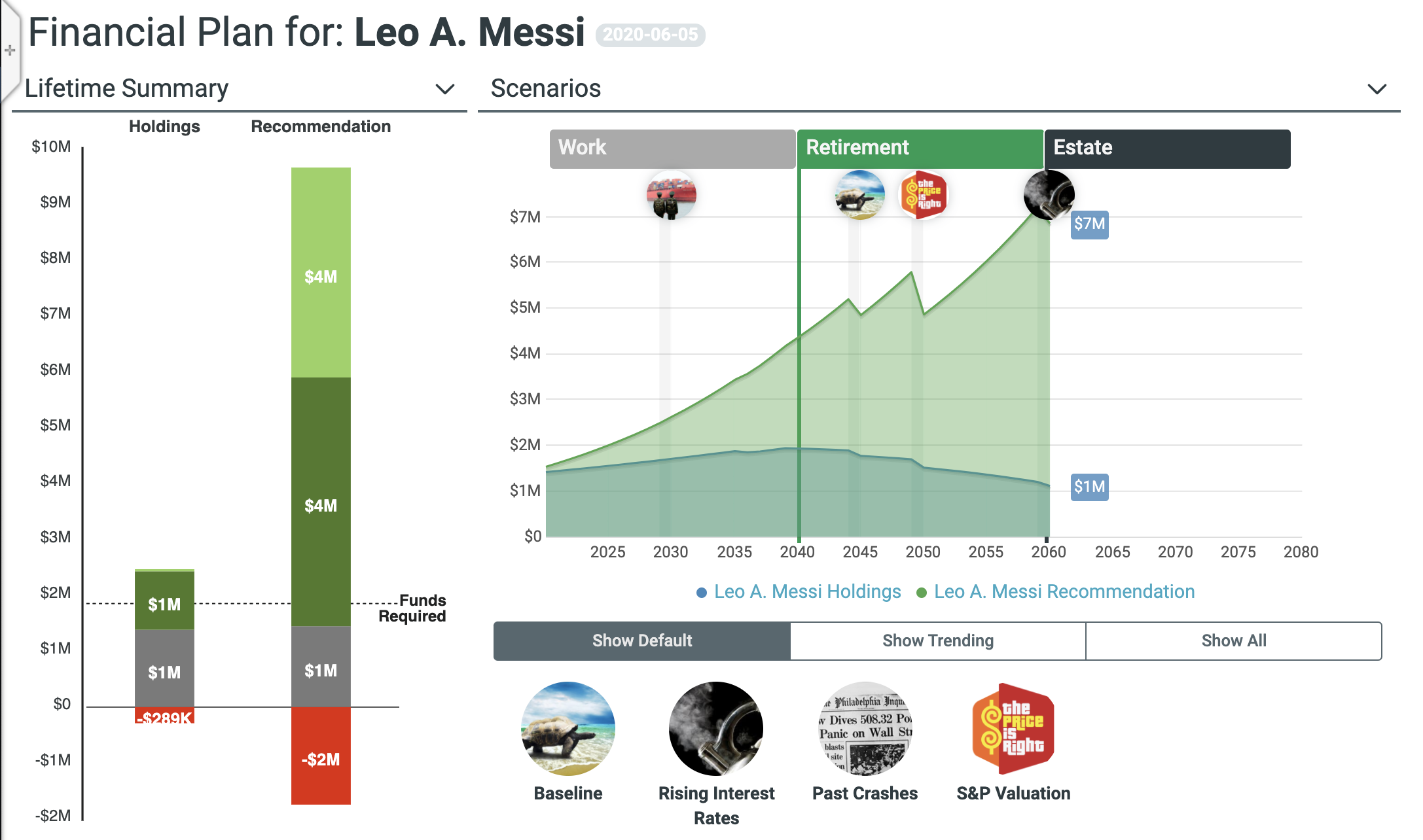

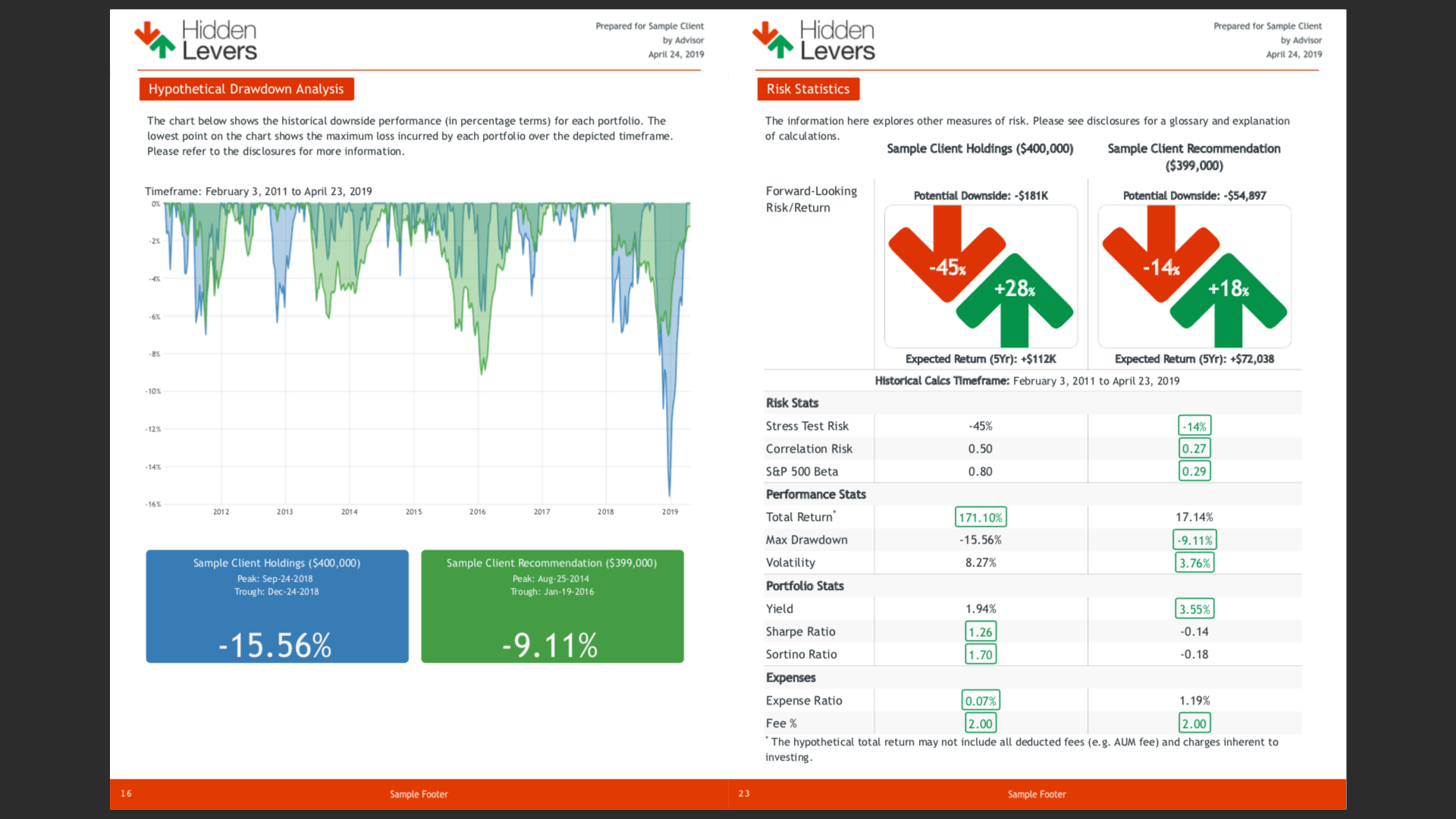

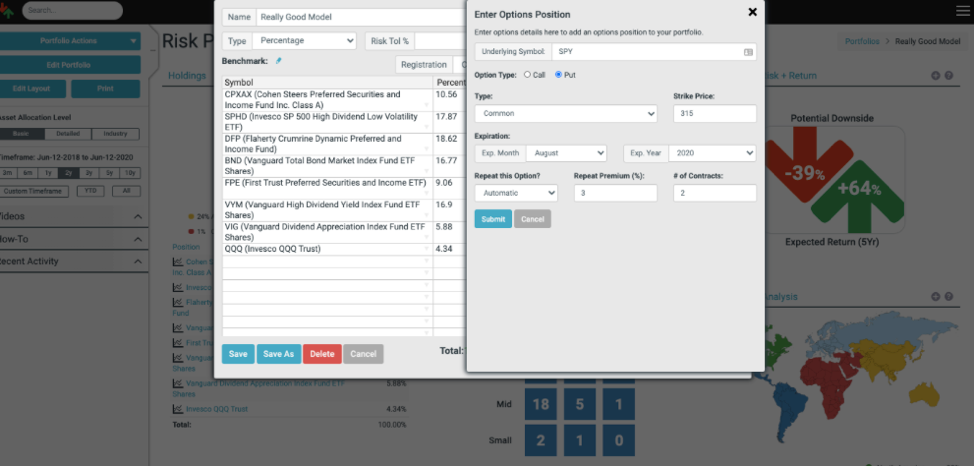

HiddenLevers is a risk technology platform providing next-level applications for the wealth management space. With over $500 billion in assets on our platform, HiddenLevers offers client-facing and home office solutions aimed at executives, financial advisors, asset managers, and portfolio managers. The cloud-based platform includes a cutting-edge macro-scenario library portfolio stress testing, model construction, investment proposal generation, and enterprise risk and revenue monitoring.

HiddenLevers

Images

Check Software Images

Customer Reviews

HiddenLevers Reviews

Daniel C.

Advanced user of HiddenLeversWhat do you like best?

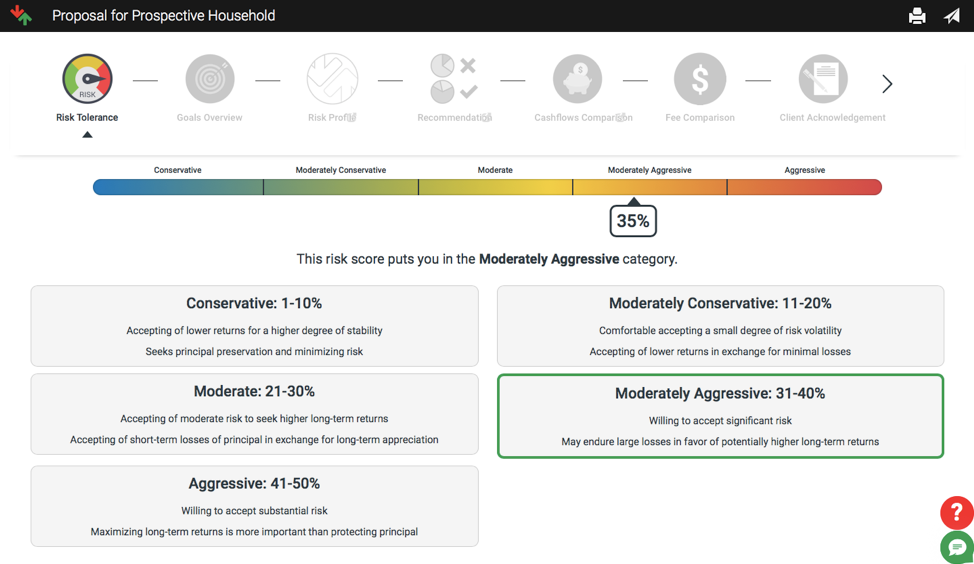

I like the investment risk scores along with the integration with Raymond James. I can quickly see how much risk is in a client's portfolio. The questionnaire is simple and easy for the client to understand.

What do you dislike?

I dislike that it cannot comprehend certain investments like structured investments or annuities with their guarantees. Some UITs are also missed. This leads to a misleading risk score. I also dislike how the risk questionnaire scores all come back between 15 and 25 regardless of their answers; someone young and wants risk will come up with a 38 which is 75% stocks. I find that incorrect.

What problems are you solving with the product? What benefits have you realized?

I am using the questionnaire to determine a clients risk tolerance and using the integration from Raymond James to determine where their portfolio is rated at. If the answers are off, we will make recommendations for a broad-based asset allocation change. Its helpful to explain it that easily and clients enjoy the conversation.