Gust Equity Management (GEM) is a Software-as-a-Service platform simplifying the process of managing the evolution of enterprise capitalizations from startup through sale/IPO.

Managing an enterprise capitalization table via Excel as well as the related documentation becomes a time-consuming and difficult process as a venture evolves, raises money, and grows.

If early-stage startups trivialize or ignore their cap tables, mismanagement can cause significant expenses down the line when lawyers come in to clean it up, can create shareholder disputes, and might even kill an M&A deal.

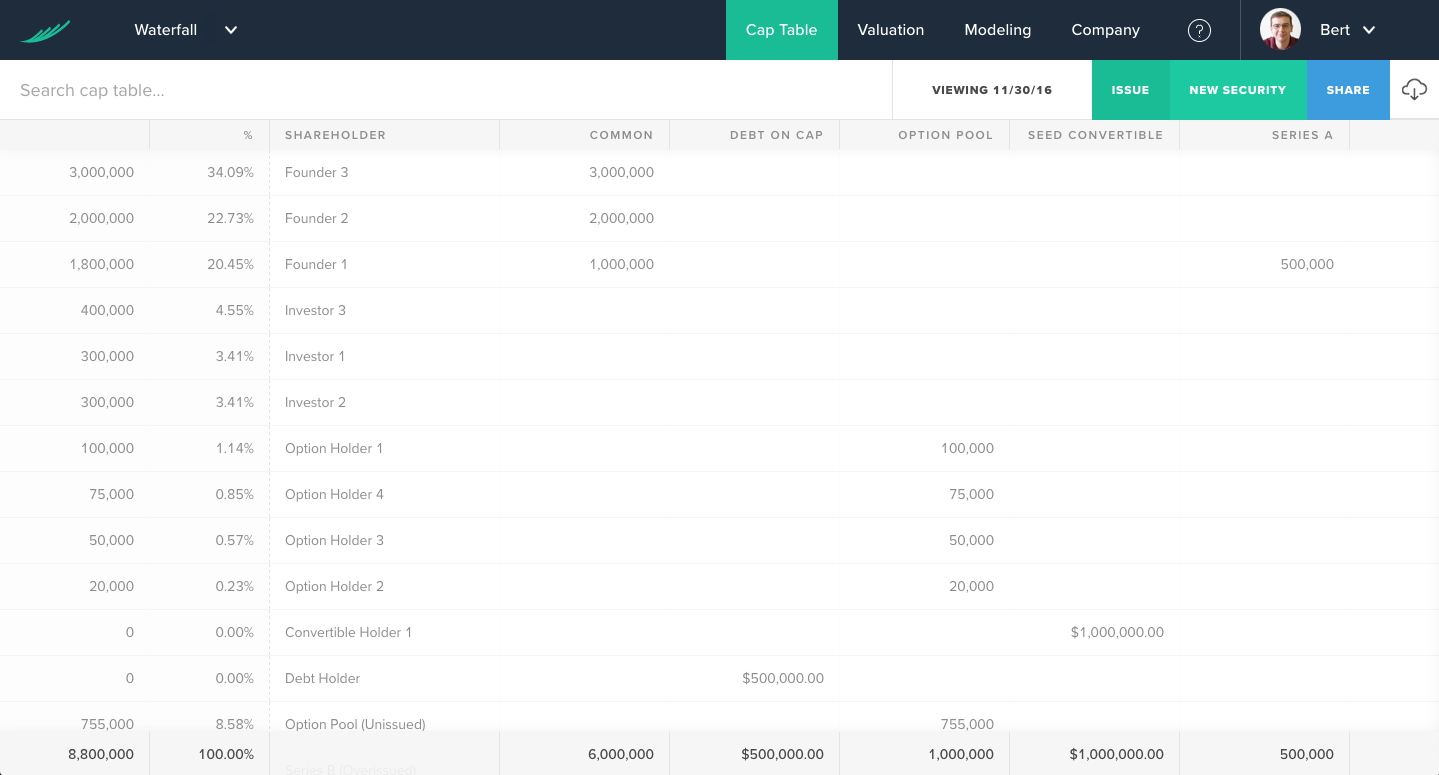

To put this into perspective, as an enterprise moves through its funding stages and development, it will typically deal with hundreds of equity issuances, option grants, exercises, forfeitures, transfers, vesting dates, board approvals, etc. All of these events must be tracked along with the underlying legal documentation in order to be auditable by shareholders and other interested parties.

Because this kind of administrative work usually falls to legal counsel, it traditionally costs $200-500 an hour. To minimize costs and time investment, GEM corrects this inefficiency with tools that make the process easier, faster, and cheaper than traditional means.

At its core, the GEM platform empowers internal or external administrators of the capitalization table by providing powerful and intuitive tools to track all the required documentation of any equity issuance, in one easy to use interface. In GEM, administrators can issue equity grants directly to employees / advisors through the platform, so there is no need to contact legal counsel every time they hire a new employee and need to issue grants.

Through GEM, users can also request 409A valuation reports so they can issue option grants at a fair market value, avoiding tax consequences for both employees and the enterprise. GEM also handles ASC718 calculations (stock option expensing), a time-consuming and expensive exercise for GAAP-compliant financials.

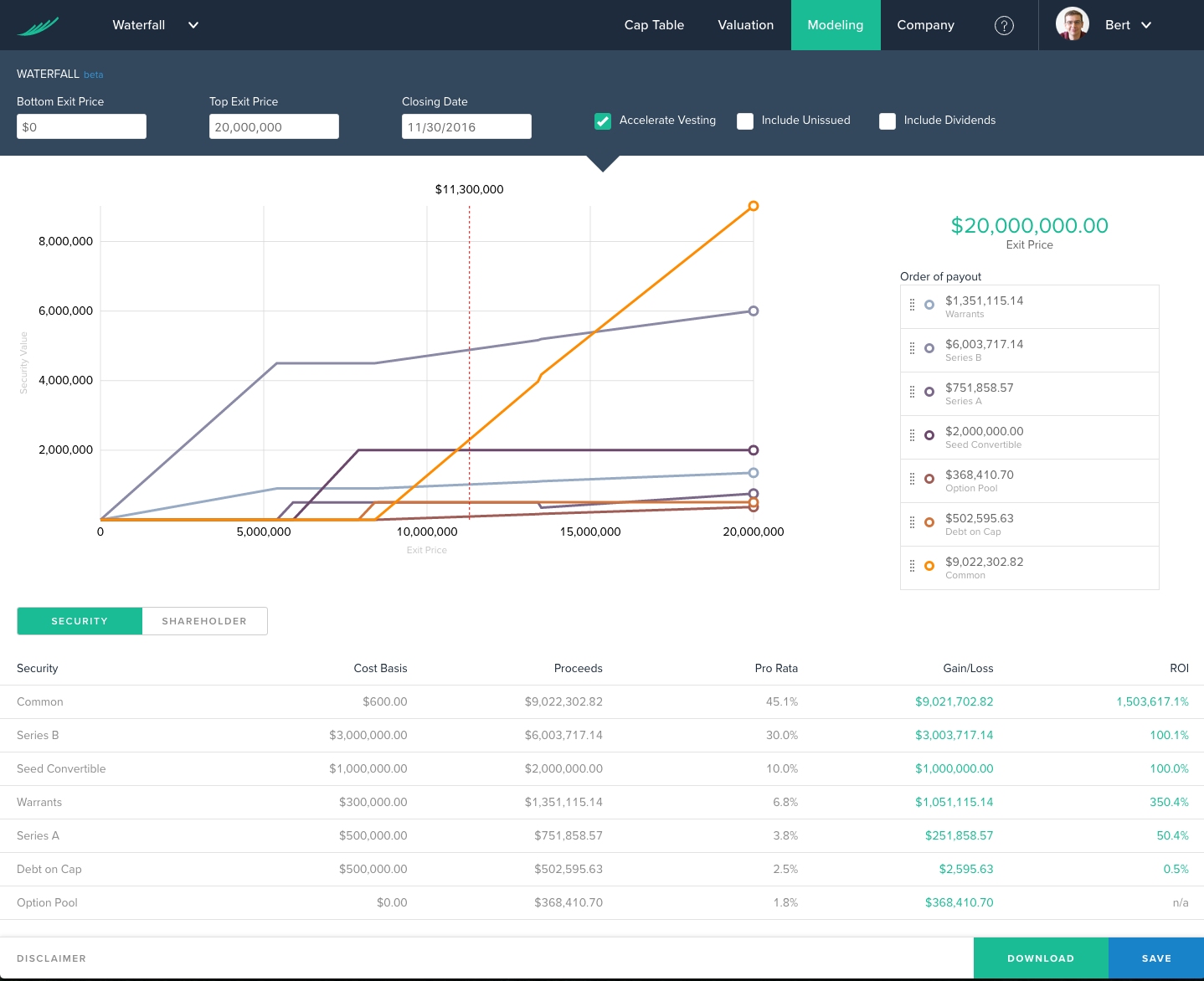

GEM also includes round modeling to see dilution impact on future equity and convertible note financing rounds, a time-hop feature allowing users to view the capitalization at any point in time, views for employees to track their equity vesting in real time, and other value-adding features.