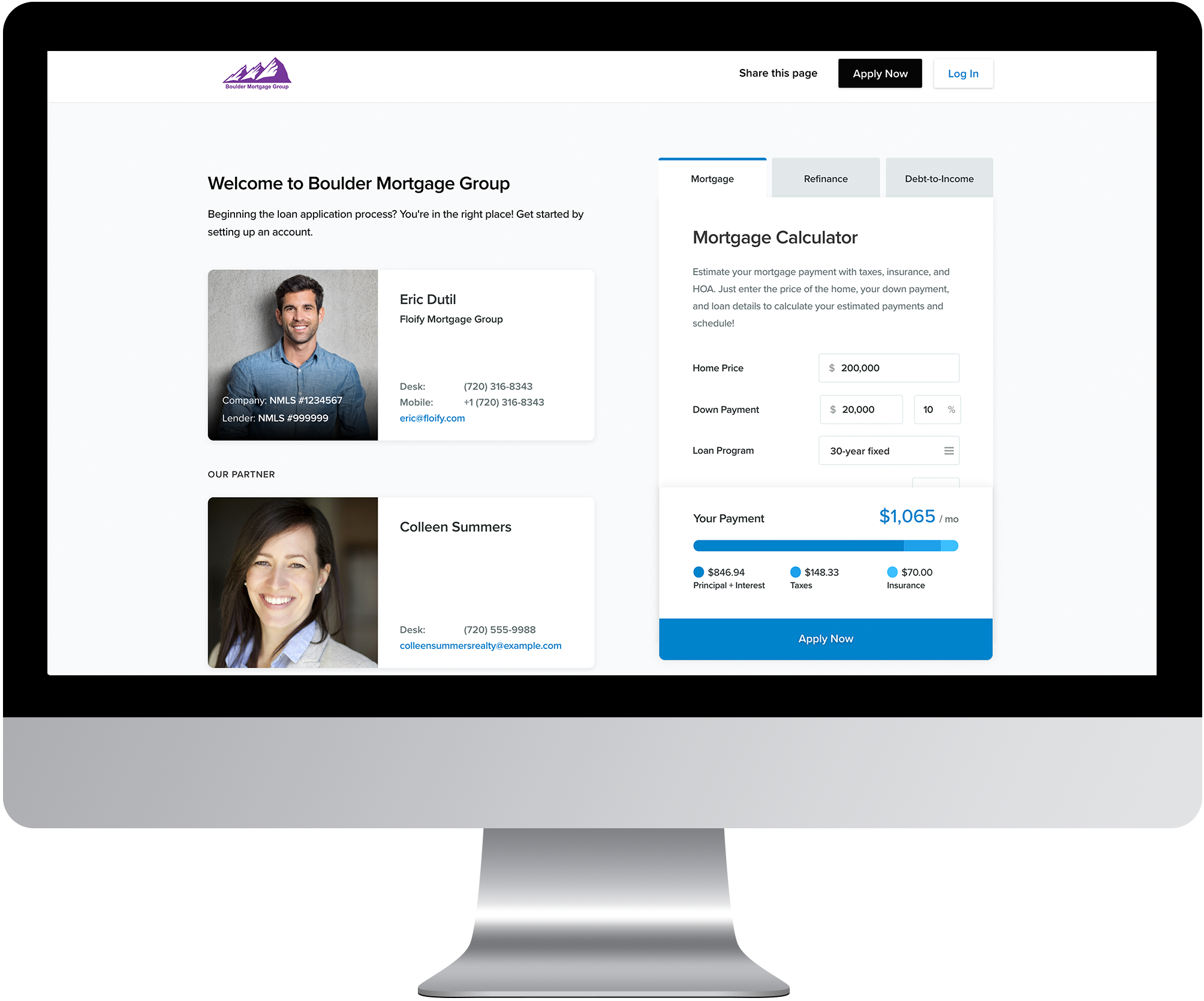

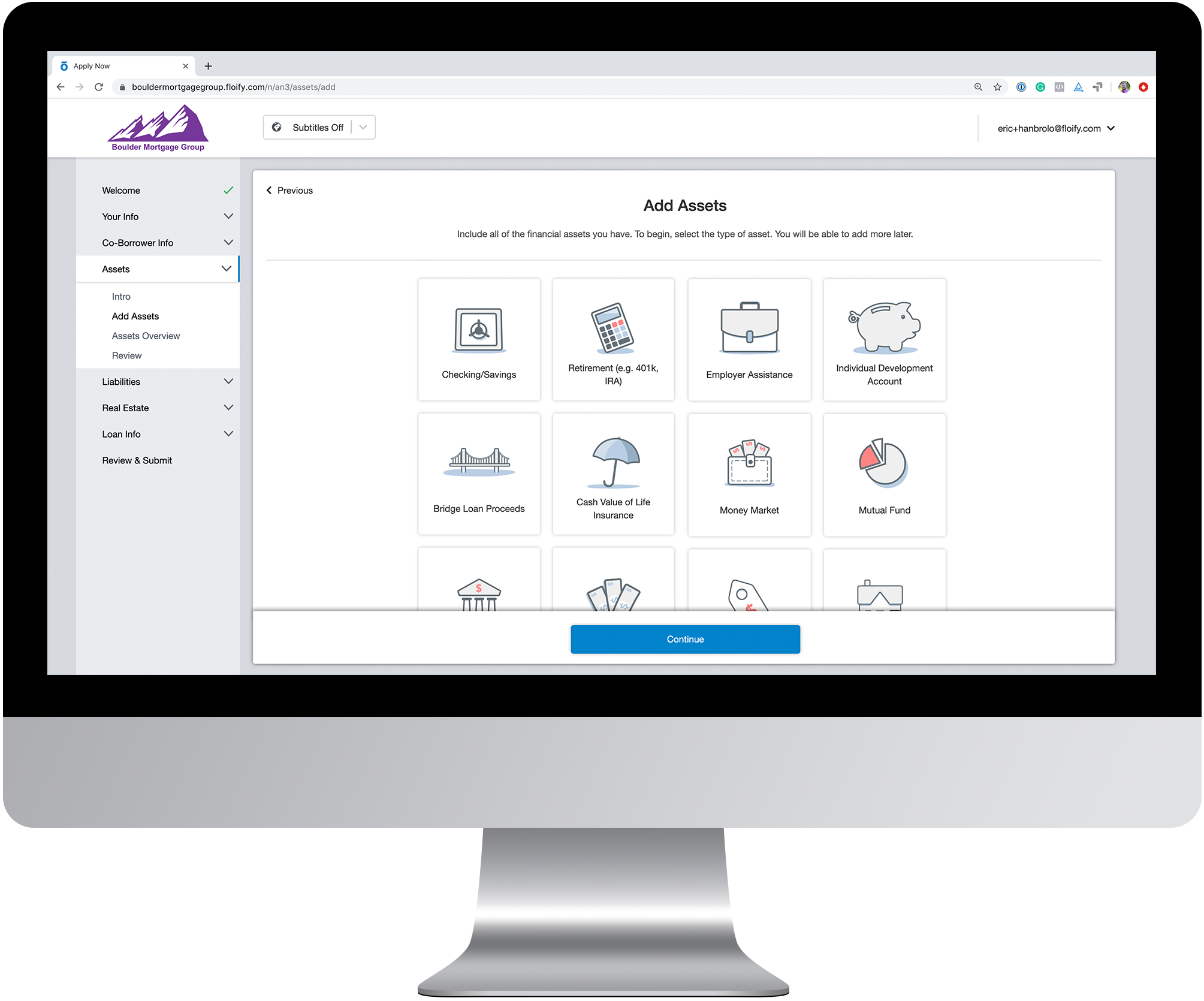

Floify is an automation solution for the mortgage industry that streamlines the loan origination process by providing a secure communications and document management portal that is shared between lenders, borrowers, real estate agents, referral partners, and other loan stakeholders. Mortgage brokers and loan officers use Floify to digitally collect and verify borrower documents, track loan progress, communicate with borrowers and real estate agents, and close loans faster and easier than ever.

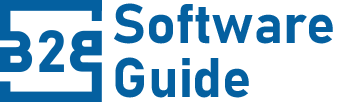

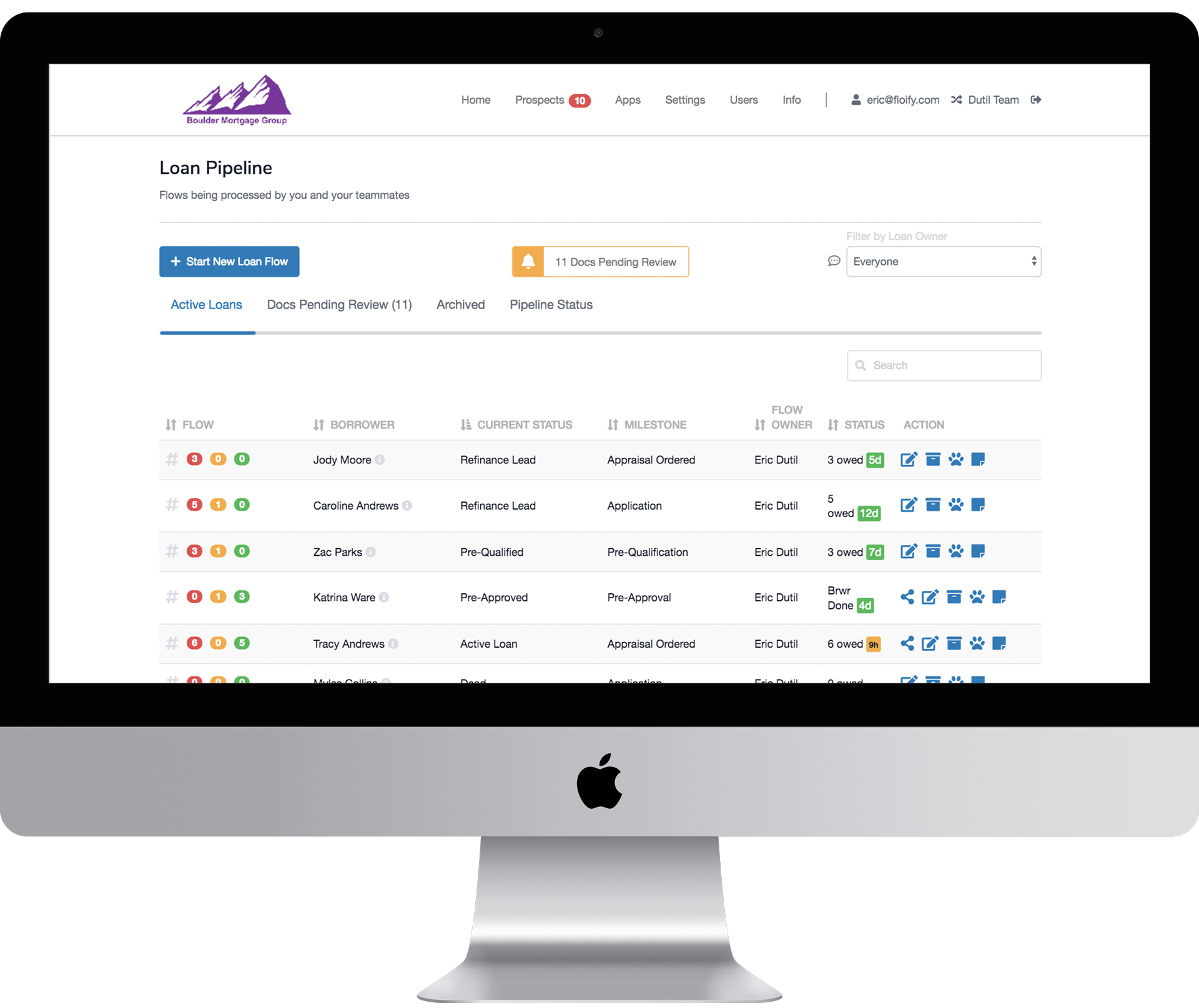

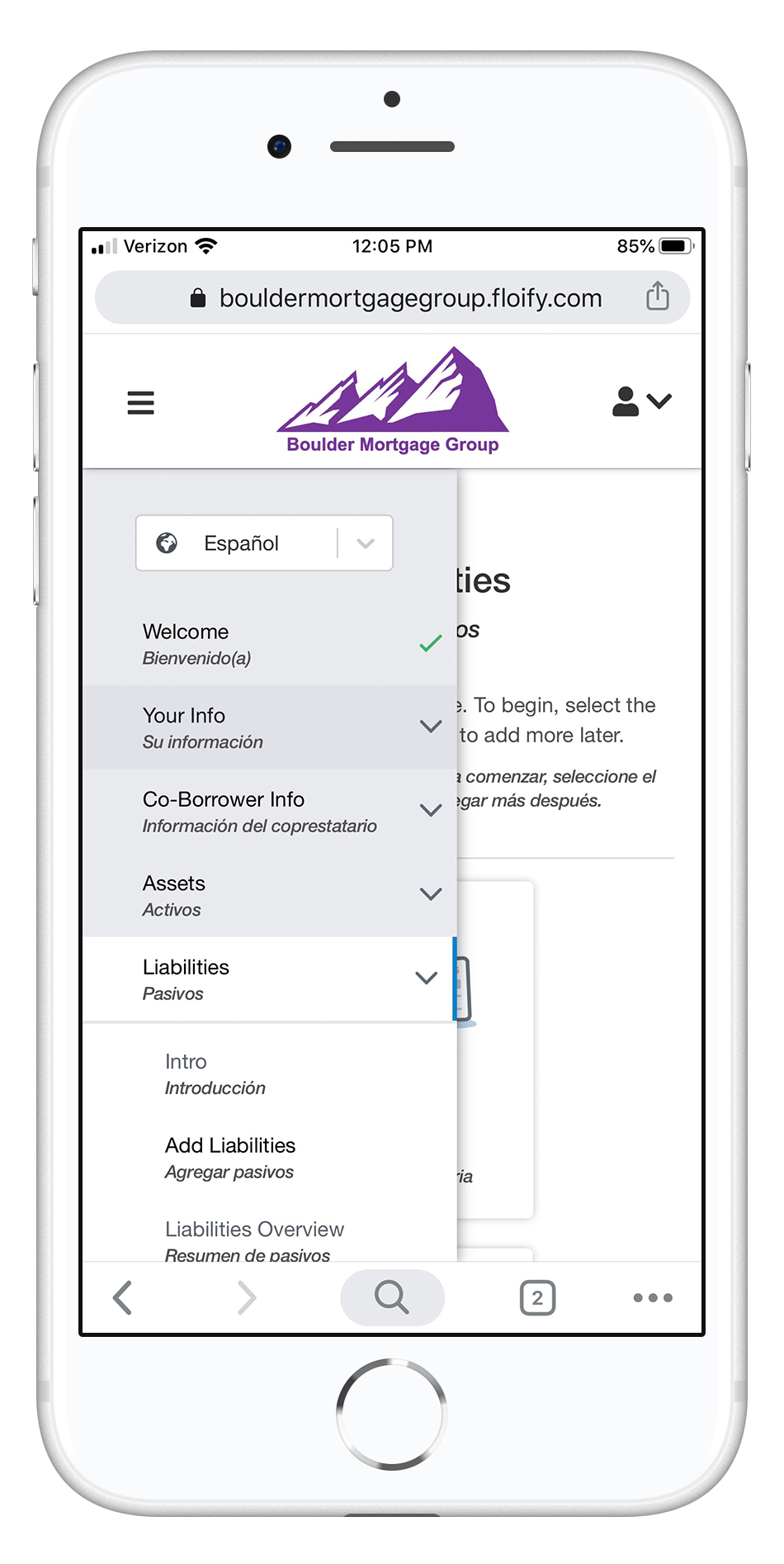

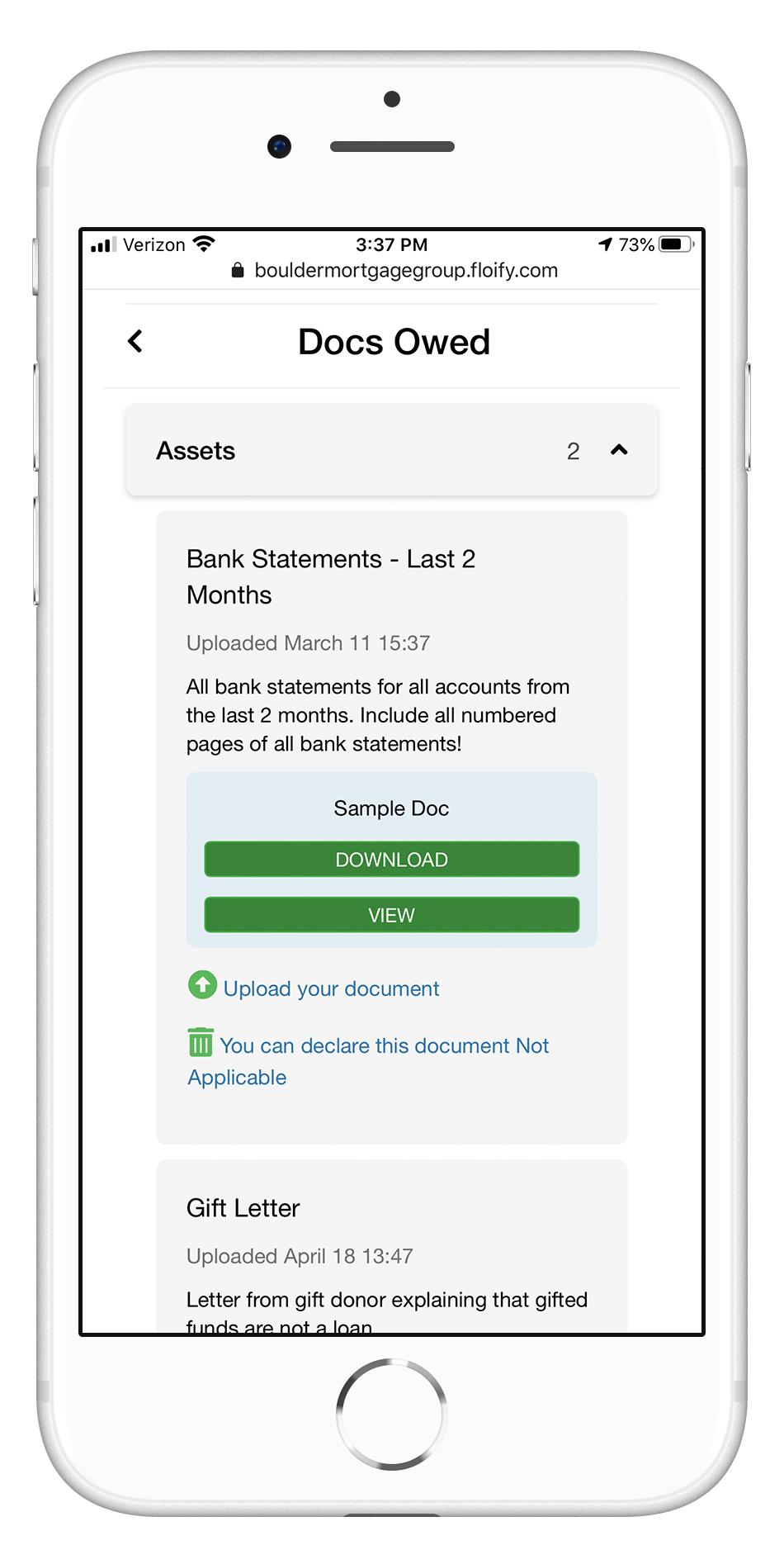

Floify also includes an easy-to-use 1003 mortgage loan application that can be embedded on a lender’s website, customized, and seamlessly synced with a respective loan file, which allows lenders to deliver a fully branded and efficient mortgage experience. As the borrower’s application moves to the underwriting stage, Floify keeps borrowers and other stakeholders informed of loan status changes via automated email and text message alerts. Floify’s responsive design works great on mobile web browsers and the platform is also accessible via mobile apps for both Android and iOS devices, so users can view their loan file and upload additional documents from anywhere in the world.

In an effort to create additional time-savings for lenders, Floify also integrates with several dozen product and service providers in the mortgage industry. These include popular customer relationship management (CRM) solutions, as well as dozens of credit reporting agencies and third-party software providers already employed by most lenders.

To help further reduce the high costs associated with loan origination and maximize lender ROI, Floify offers a fixed monthly or annual subscription pricing model with no per-loan fees, which enables lenders to enjoy additional increases in profitability, especially as their loan volume grows.

When using Floify to facilitate the mortgage process, loan originators report being able to save up to 10 days on the origination process. Furthermore, lenders report reductions in workload as well as an increase in volume – all while dramatically improving lender-borrower communication and overall satisfaction with the mortgage process.

Request a demo to learn more.