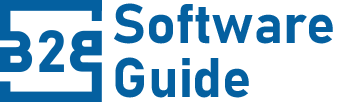

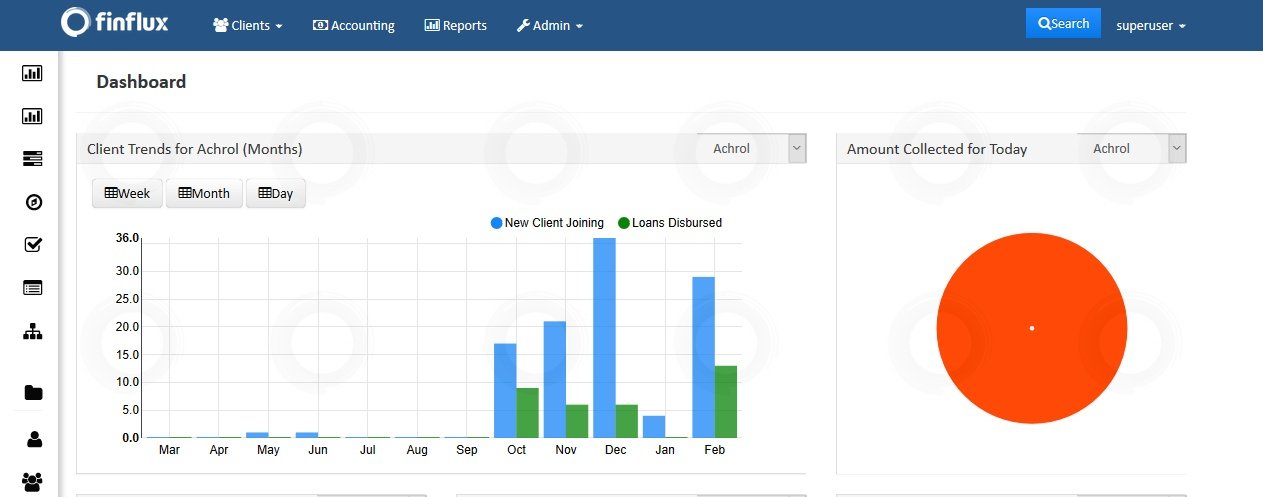

Finflux is SaaS based lending platform that offers all-in-one solutions for needs of loan origination, loan management, financial accounting, marketplace integration, app based lending, alternative data based credit scoring, dashboards & reporting and analytics. At present we are serving about 4+ million borrowers with active loan portfolio of $3.2 billion.

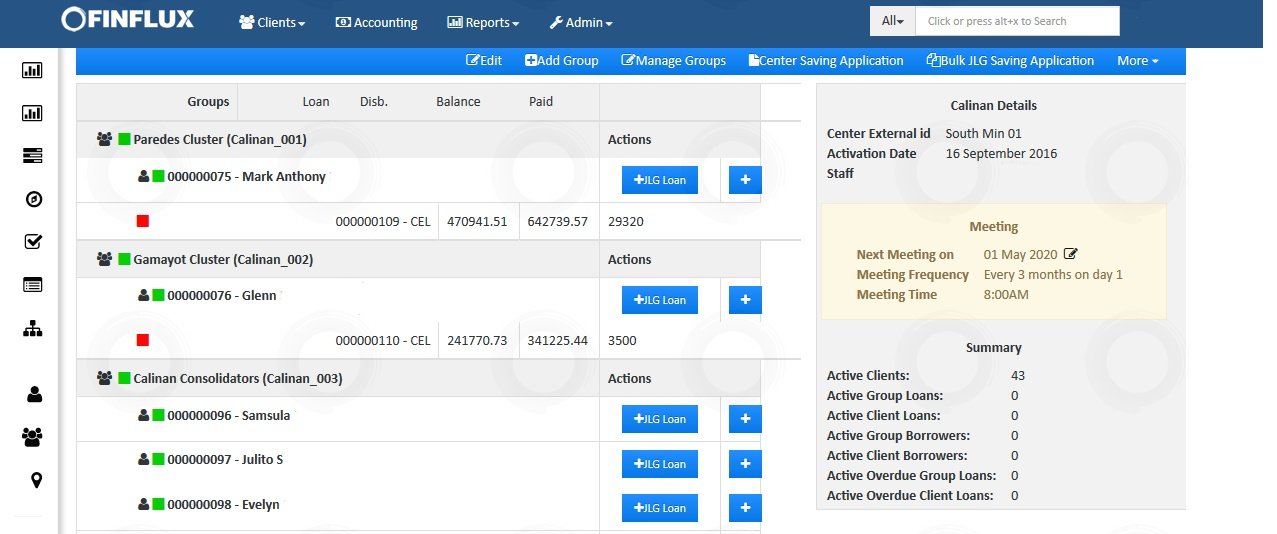

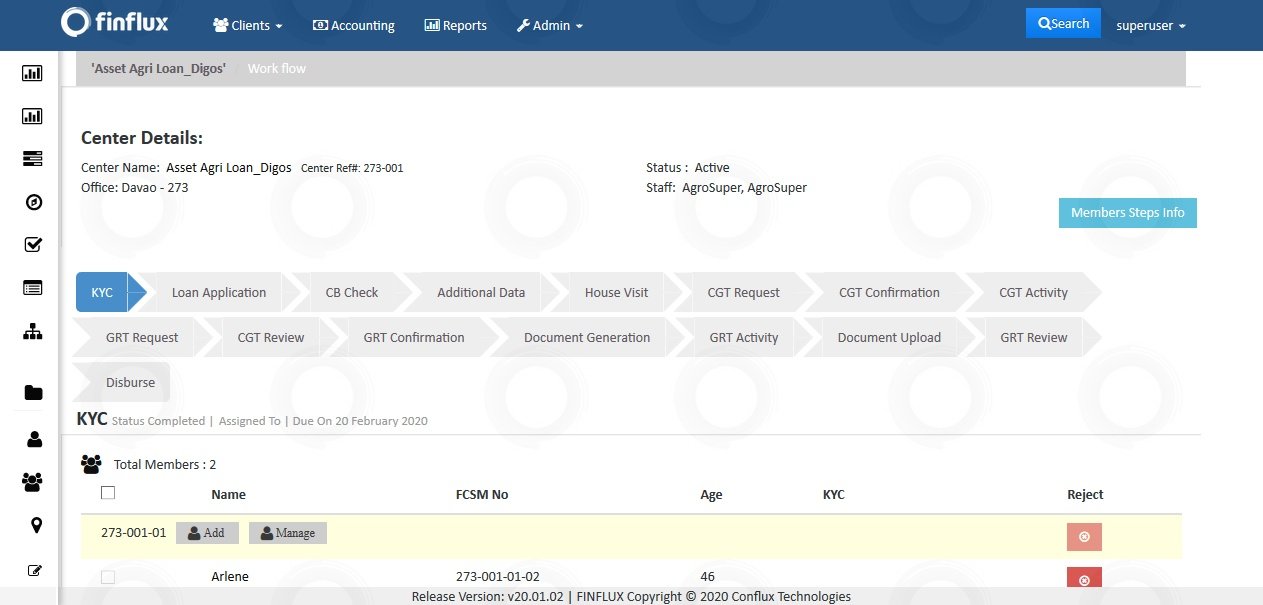

FinFlux is a fast-growing lending platform which offers classic and bespoke solutions. We can serve myriad institutions ranging from who serve the bottom of the pyramid (BOP) to nuanced (non)-banking/financial institutions. Microfinance, SACCOs, Banks, FIs, evolving Fintechs, Business Correspondents, Aggregators in origination process, Agent networks and many more.

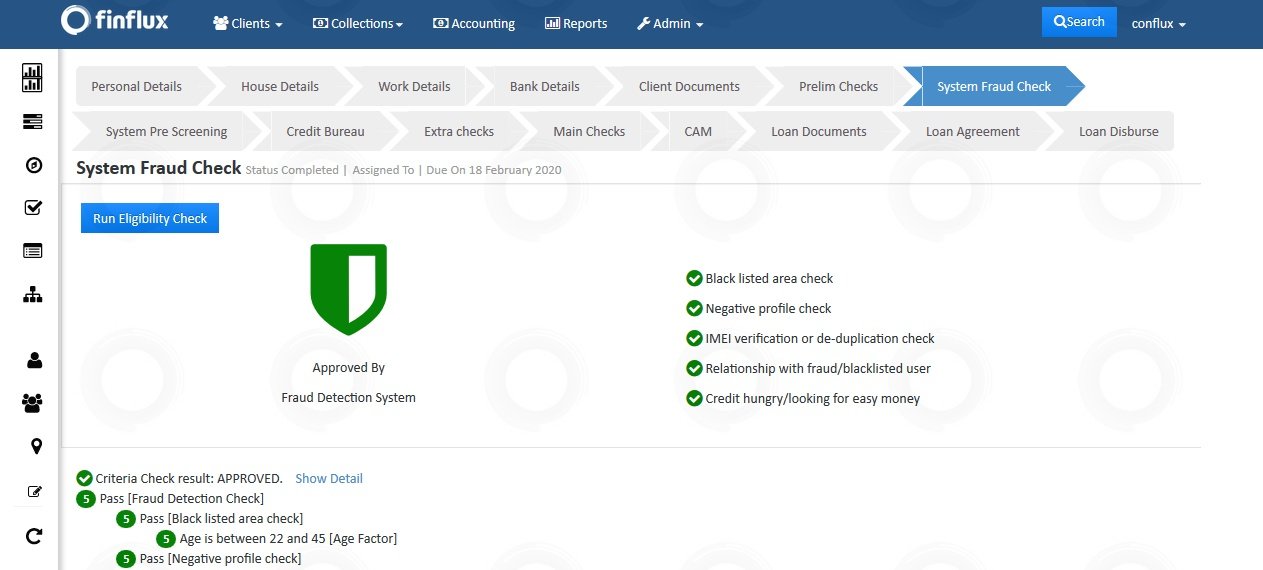

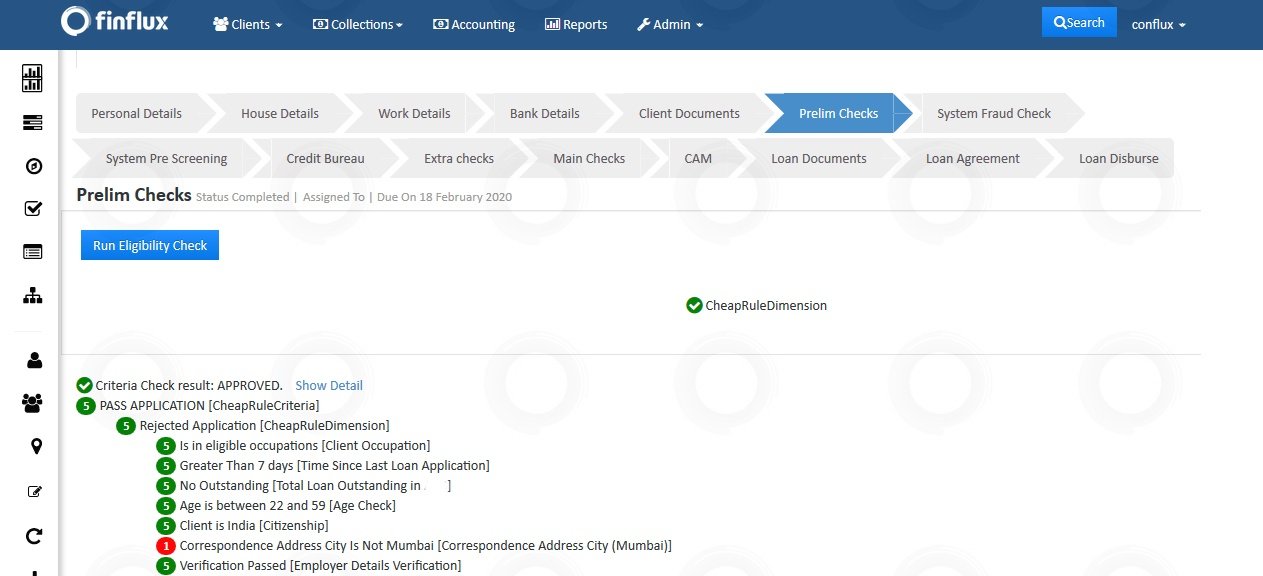

Finflux breaks the transactional input model to outcomes based model to achieve competitive advantage. Digitization, authoring underwriting rules, rules-based automation in workflows, tiered maker-checker and approvals offers differentiated customer experience and digital journey. It’s cloud-first and then mobile-first empowering the field force. The platform comes with many must-have integrations and marketplace nexus to improve the time to market. Purely a SaaS-based model, aimed truly at impeccable architecture fine-tuned for performance benefits (API round trip times < 2 seconds), banking grade security & compliance and scale on demand.