FinFit is the nation’s largest holistic financial wellness benefit that has transformed thousands of employees’ lives and helped 150,000+ employers attract and retain top talent with financial products and services dedicated to helping employees improve their financial well-being and become financially stable.

Want to know more about the FinFit products and services?

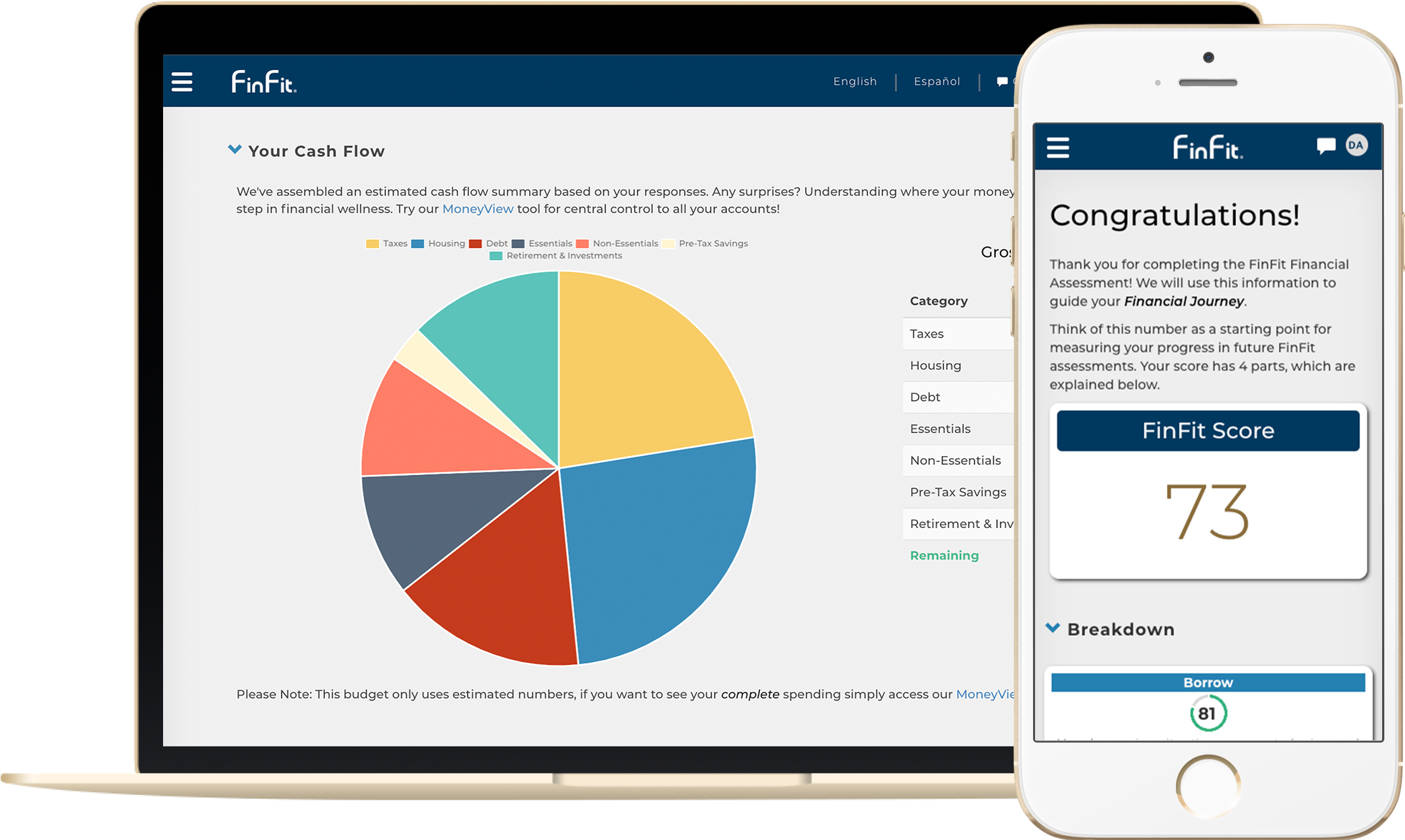

Personalized Financial Assessment

– Assess current financial health and identify goals

– Actionable plan tailored to each individual

– Personalized tools and recommendations to improve financial health

– Benchmarks showing how employees stack up against their peers

Premier Financial Education and Family Sharing

Interactive courses and playlists focused on key elements of п¬Ѓnancial well-being. Bonus: employees and their families can build strong financial foundations together with Ready University’s Family Sharing program.

Course topics range from:

– Managing Credit/Debt

– Credit Scores

– Buying a Home

– Budgeting & Saving

– Investing

– College & Student Loans

– Planning for Life Events

– Retirement Planning

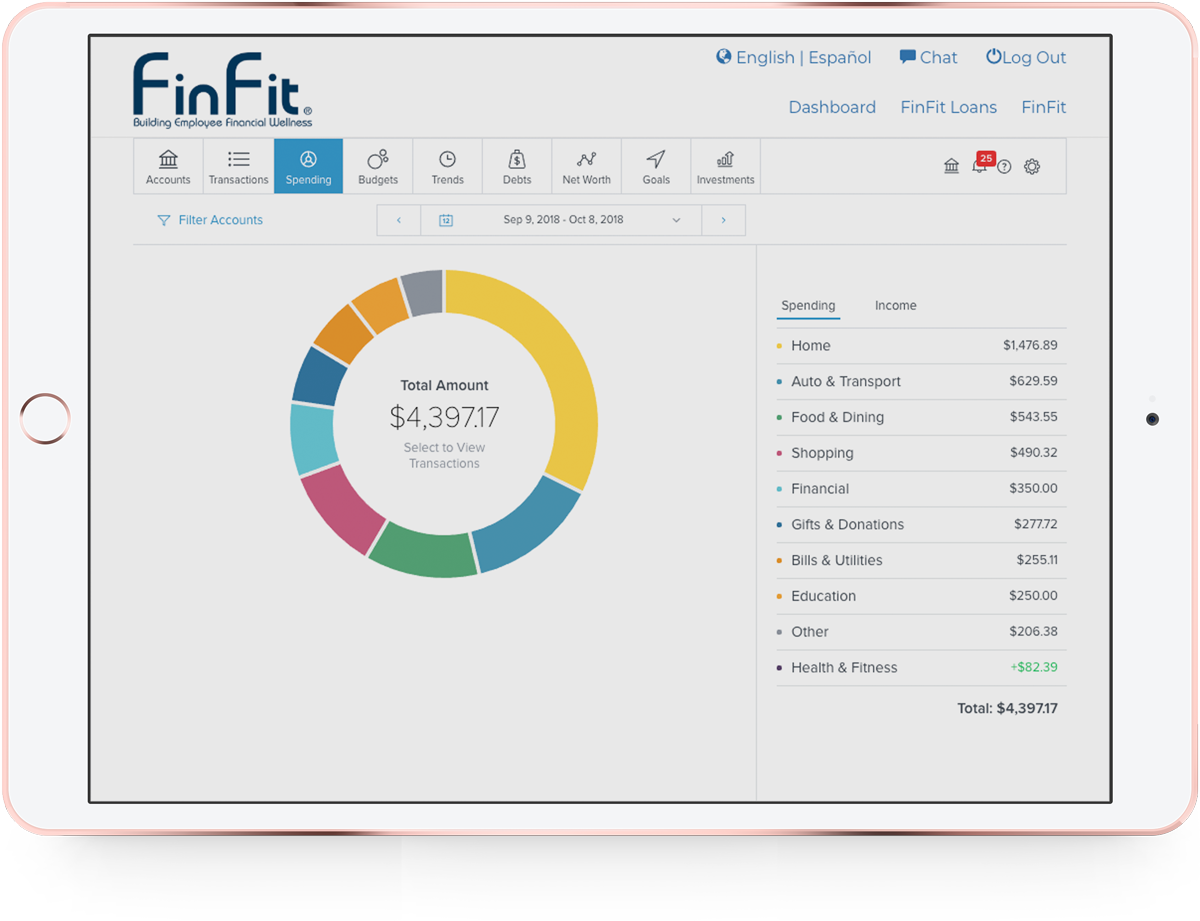

MoneyView Financial Dashboard – a Powerful Tool for managing Personal Finances

– Track spending habits

– Link all accounts for a complete financial picture

– Create personalized budgets

– Set account and spending alerts

– Identify goals and evaluate progress

Financial Coaching – Free access to top-notch, certified financial counselors

– One-on-one budget coaching

– Help with specific debt concerns

– Guidance with mortgage, vehicle or student loan decisions

– Unlimited calls and scheduled follow-up sessions

Coupon Vault – Member-exclusive access to the best, active coupon deals

– Location-based and national deals

– New coupons added regularly

– Employees will save time and MONEY!

– Unlimited access for members

Financial Calculators – make informed financial decisions on large investments

– Prepare to buy a home, vehicle or other major purchase

– Manage student loan debt

– Plan for educational expenses

– Understand the impact of debt

– Learn how to save and plan appropriately

Early Wage Access through WageNow

– Employees don’t have to wait until payday to get paid!

– Helps to eliminate expensive bank overdraft fees

– Employees can request up to 50% of the wages they’ve earned before payday

Credit & Loans

FinFit offers alternatives to high-interest credit and payday loans.

– Loans from $500-$10,000 (up to 75% of gross monthly income)

– No prepayment penalty for paying off early

– Option to process via payroll

– Equal installments every paycheck

Boost workplace productivity while attracting and retaining top talent in this hyper-competitive job market.