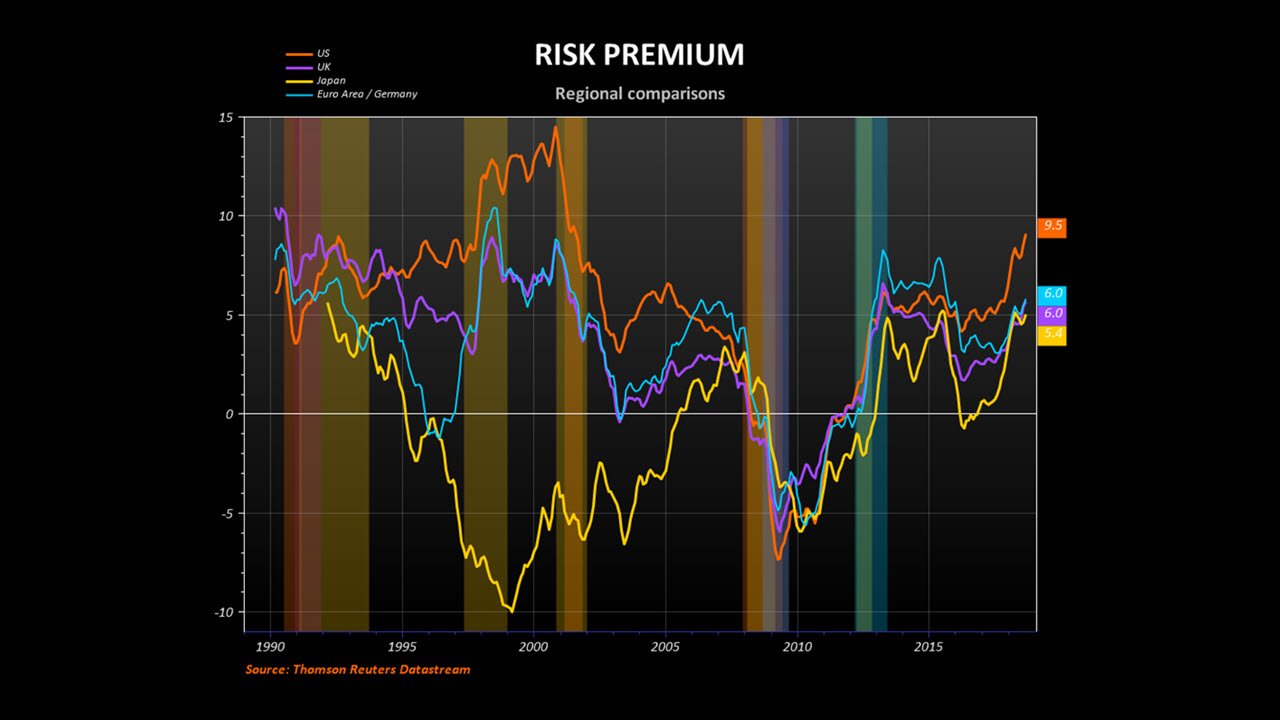

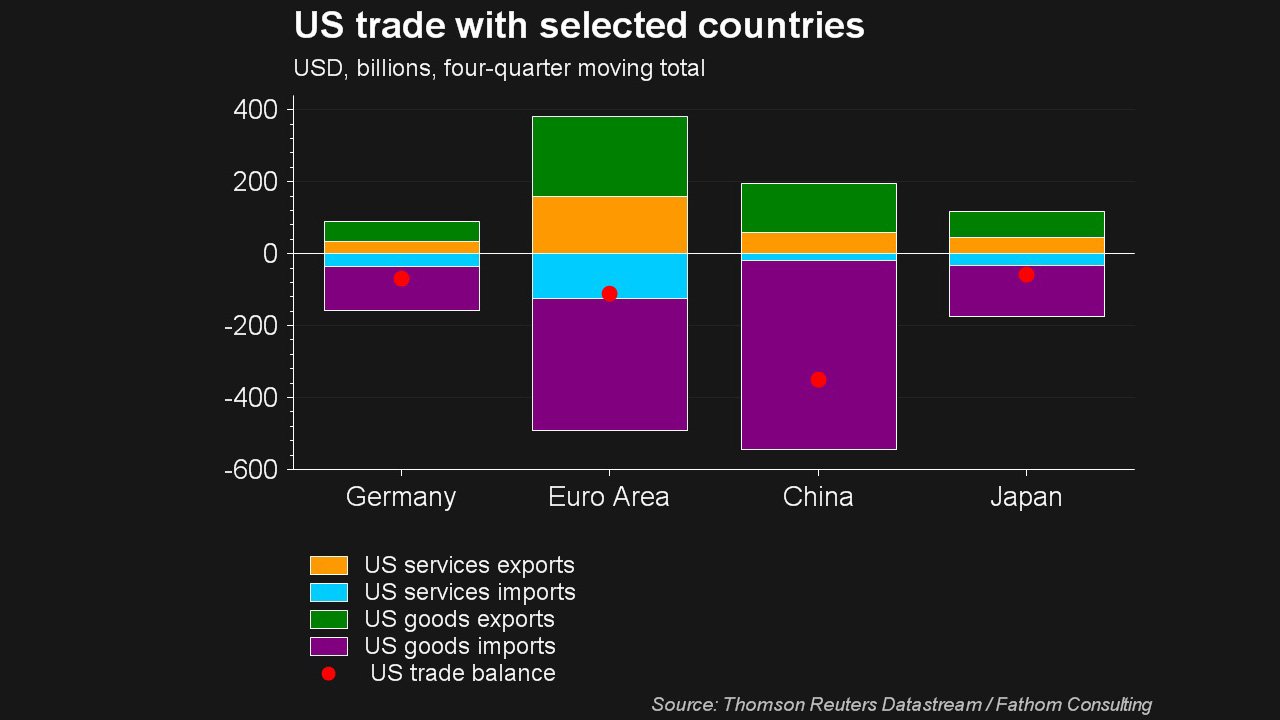

Identify trends, generate and test hypotheses, and develop viewpoints and research. Loaded with 70 years of information, Datastream is the world’s most comprehensive financial time series database.

The foundations for building your own macroeconomic analysis, creating market scenarios, and testing investment strategies should be deep and rock-solid.

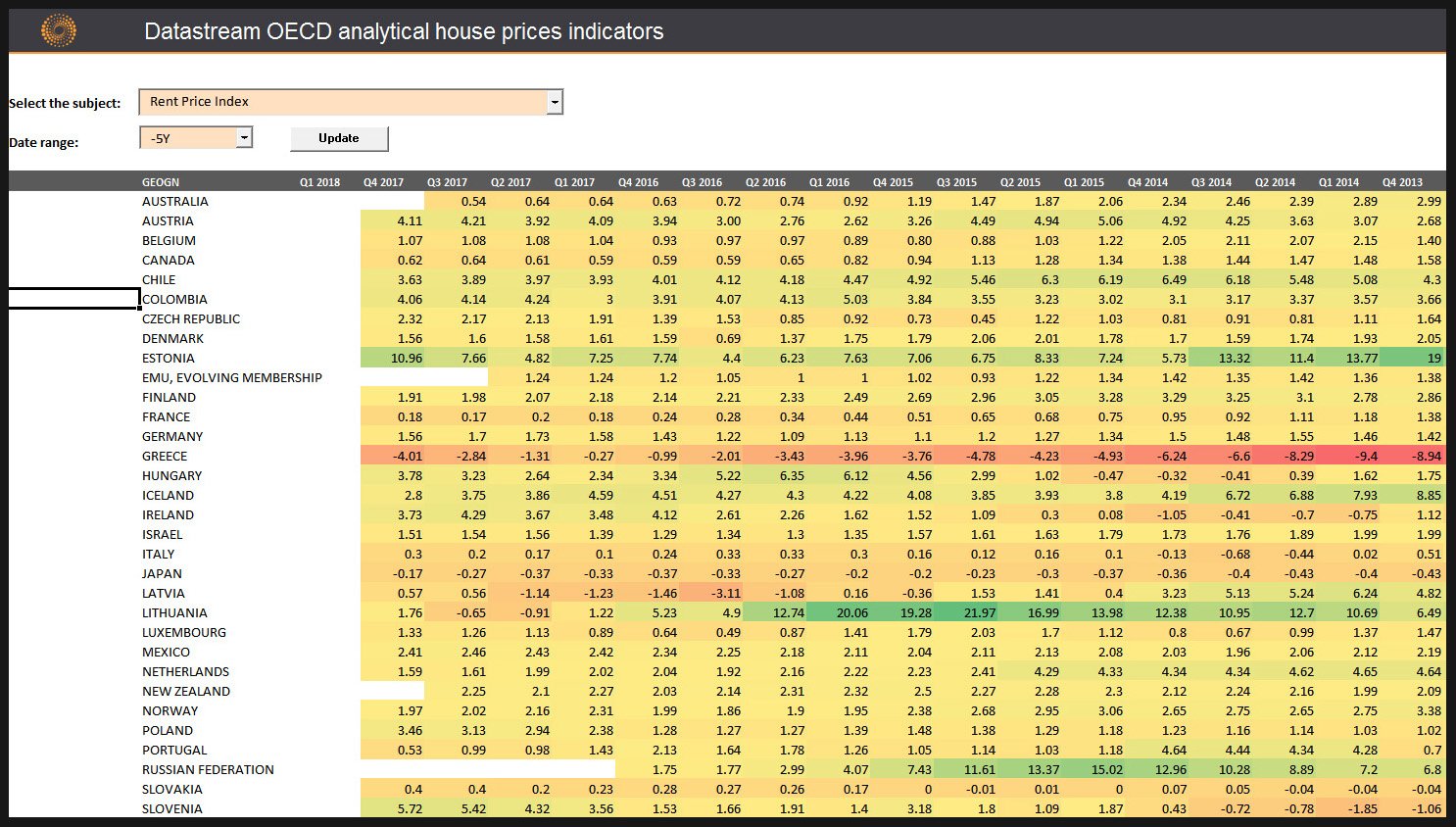

Welcome to Datastream, our historical financial database with over 35 million individual instruments or indicators across all major asset classes, including 8.5 million active economic indicators. It features 70 years of data, across 175 countries – the information and tools you need to interpret market trends, economic cycles, and the impact of world events.

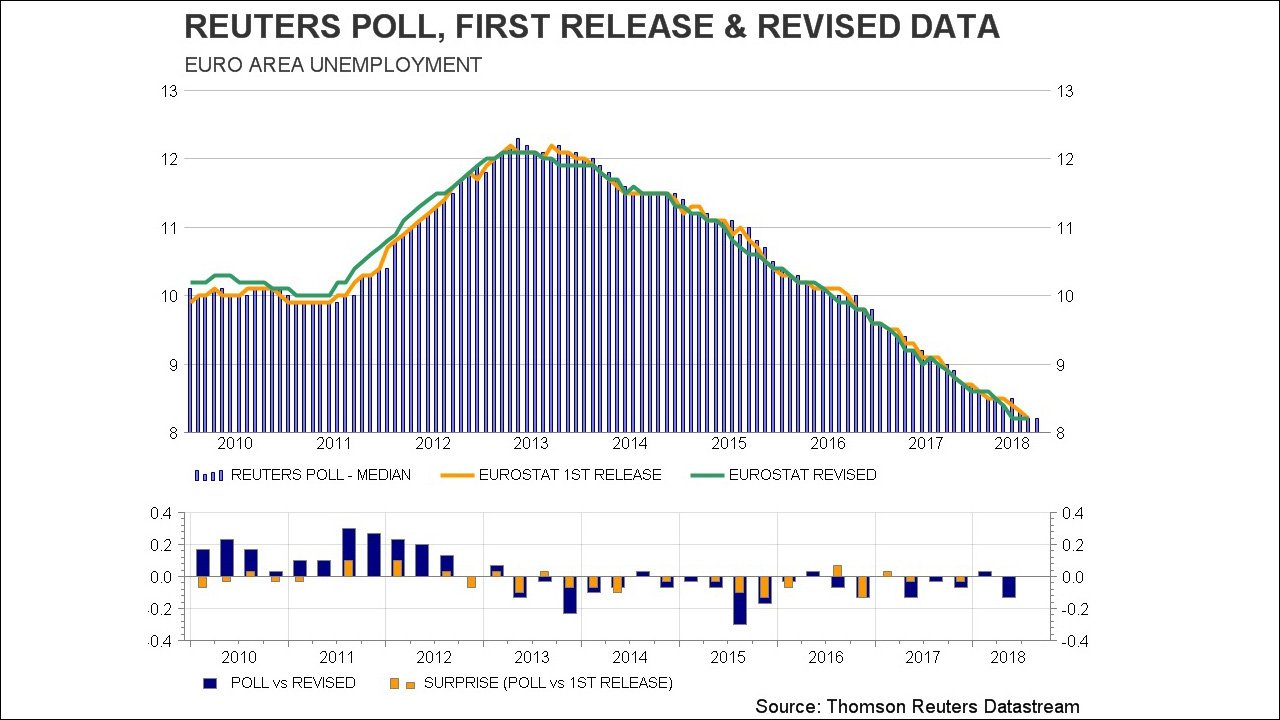

Unique content includes I/B/E/S Estimates aggregates, Worldscope Fundamentals Point in Time data, and Reuters Polls.

Data spans bond indices, bonds, commodities, convertibles, credit default swaps, derivatives, economics, energy, equities, equity indices, ESG, estimates, exchange rates, fixed income, funds, fundamentals, interest rates, and investment trusts.

Datastream can be accessed as a data feed, via an API, or integrated into Eikon, with a Microsoft Office add-in for dynamic updates. APIs for Matlab and Eviews are also available for back-testing.