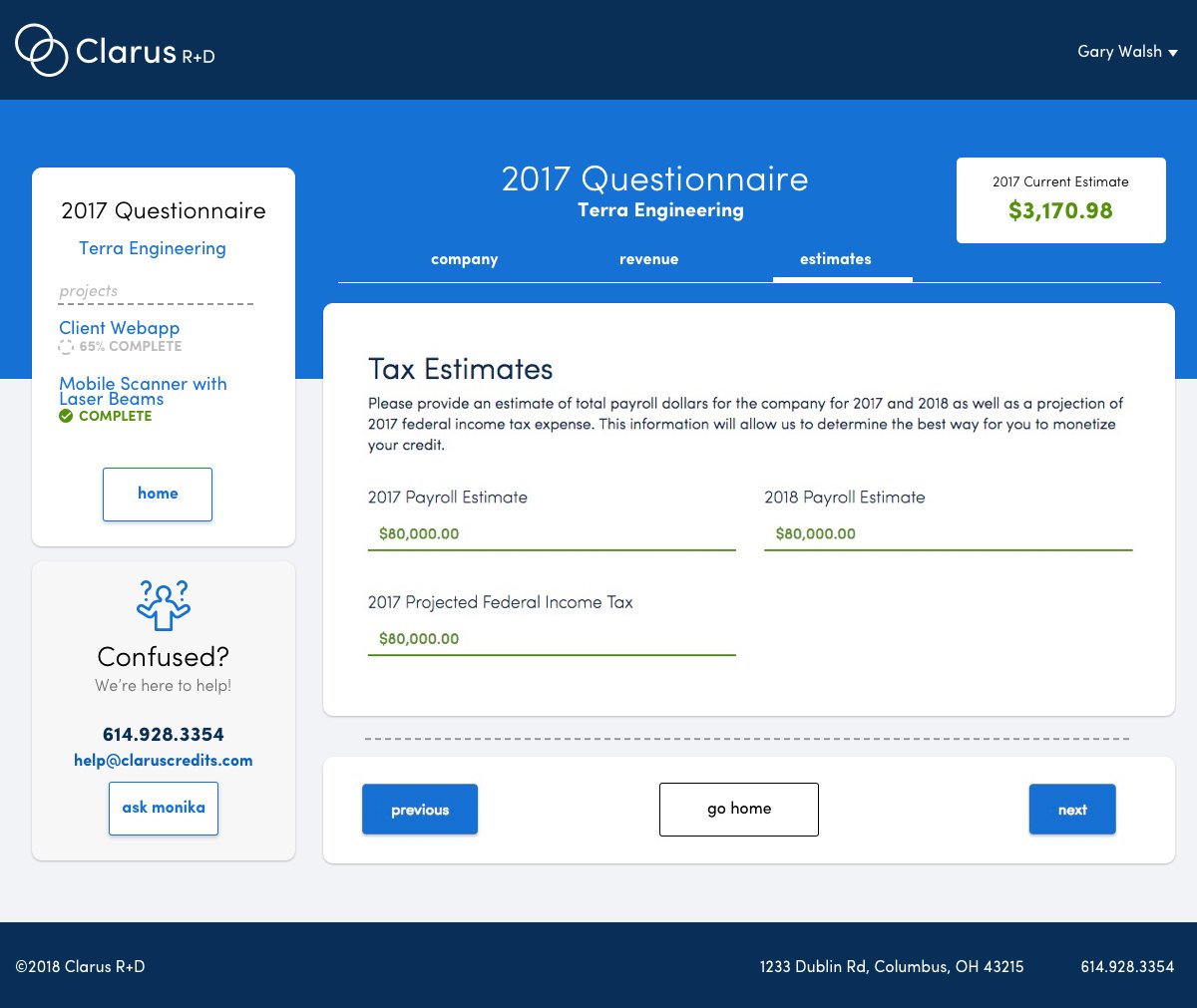

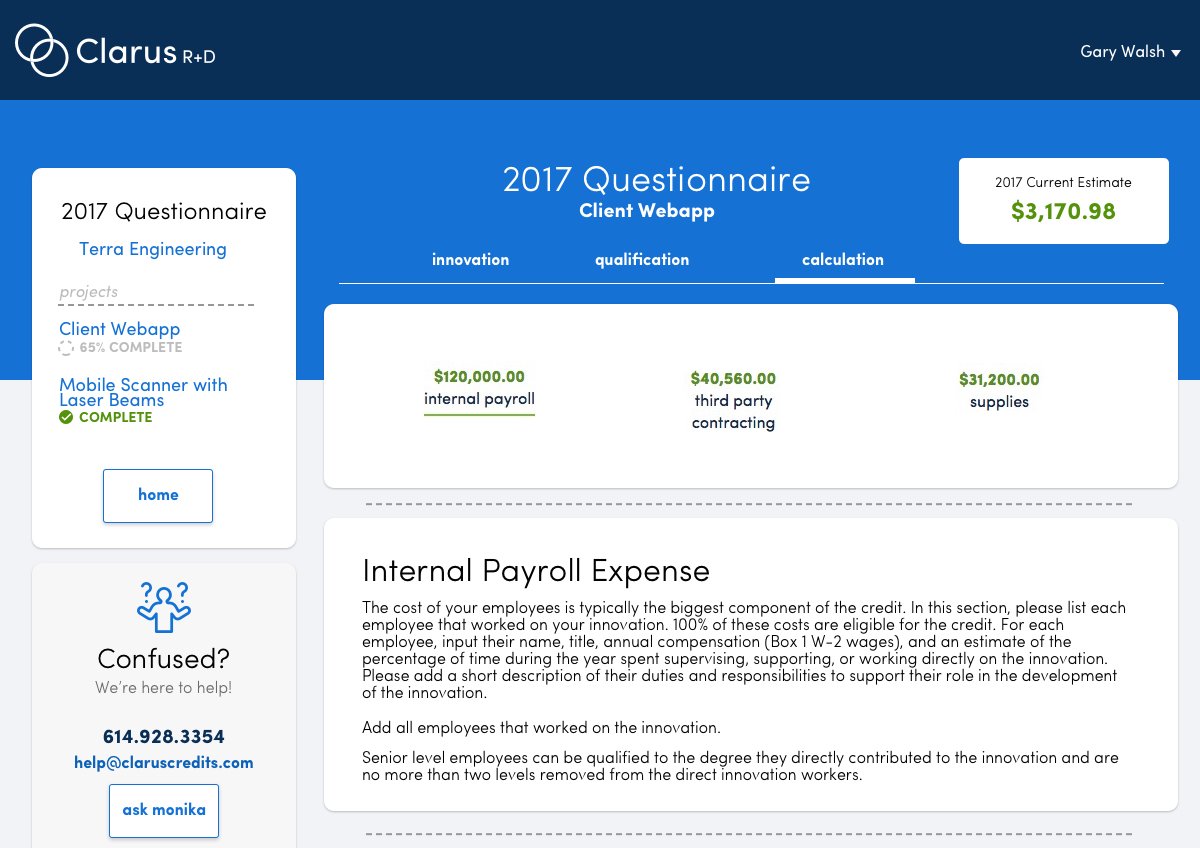

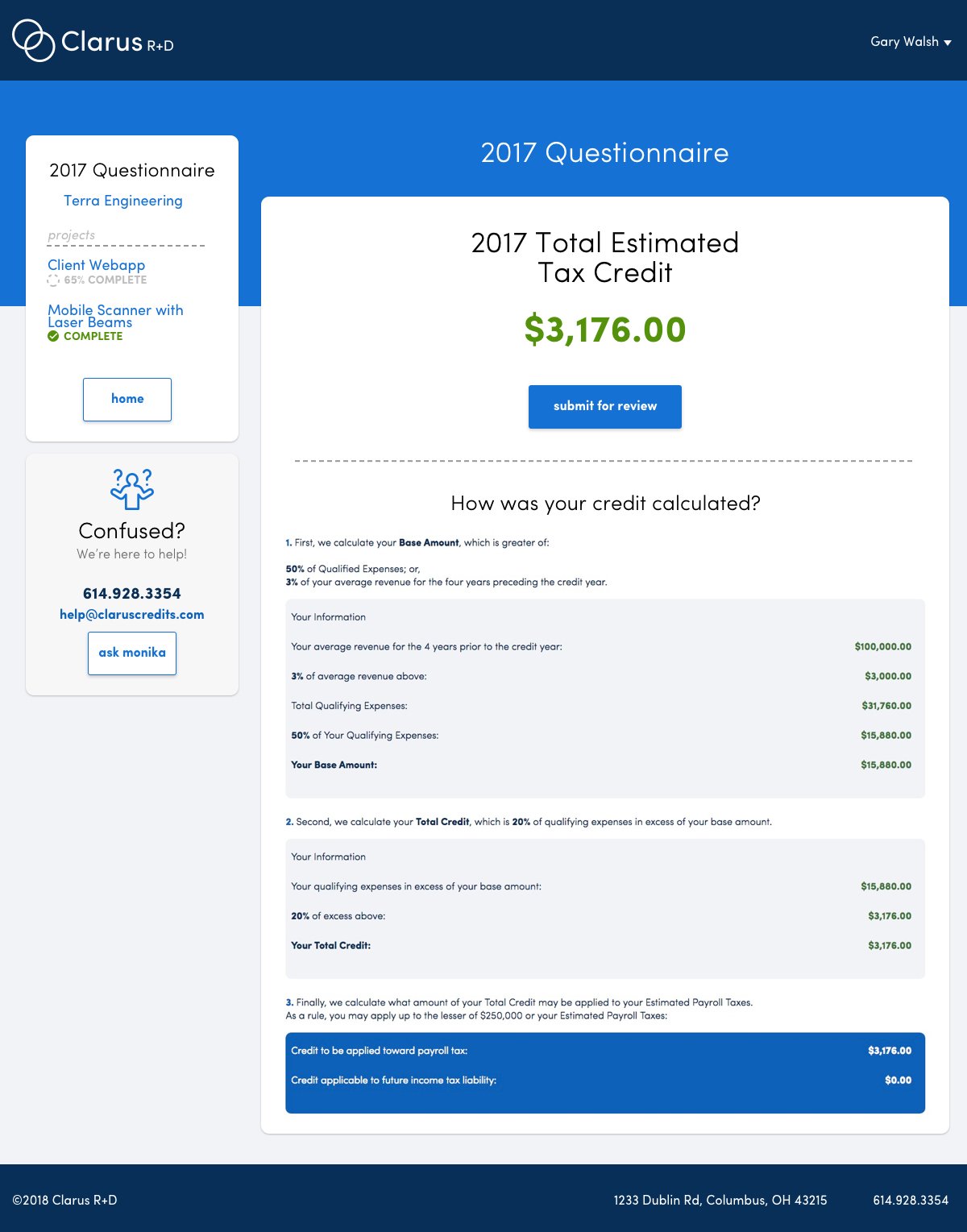

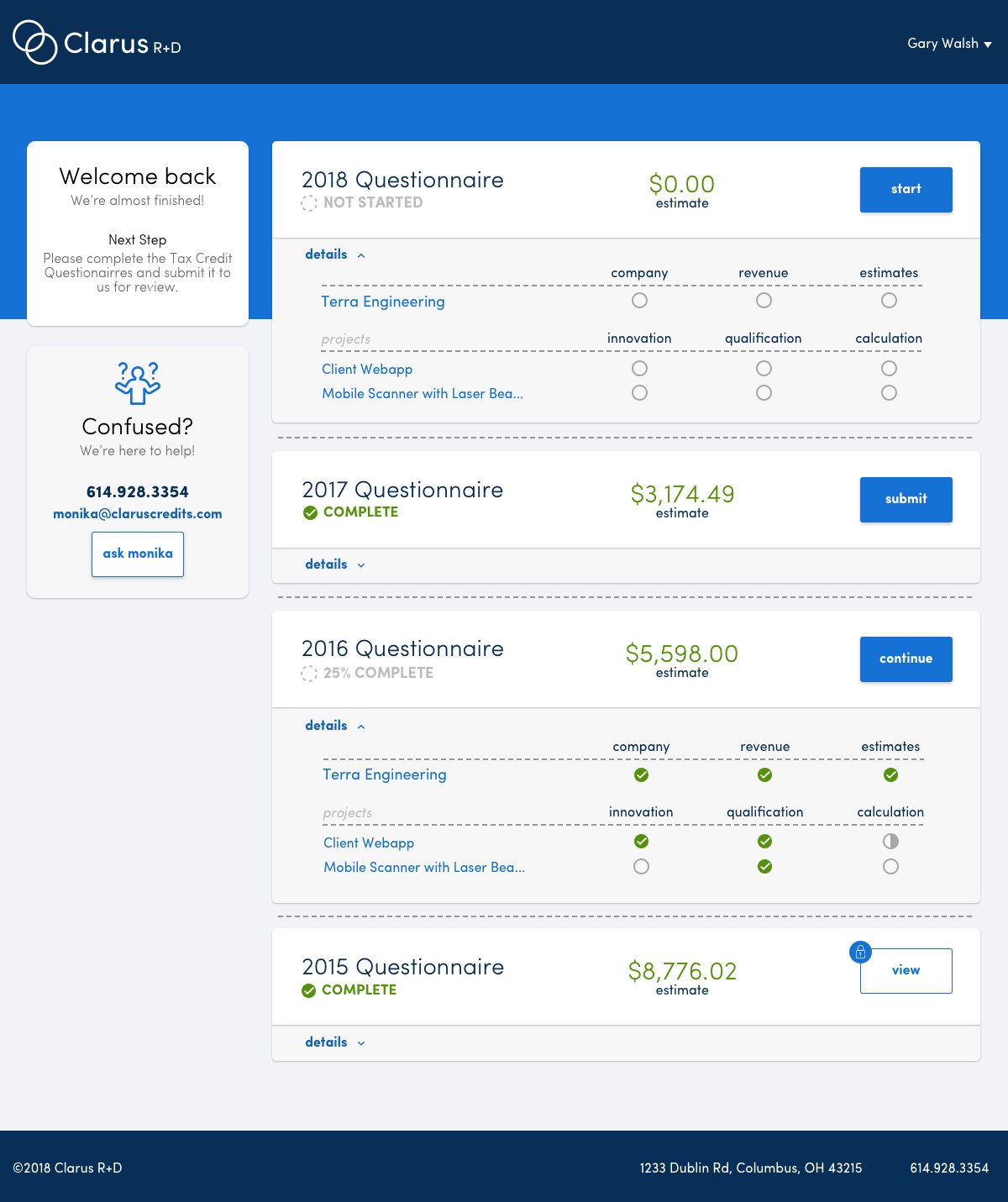

The Clarus R+D app automates the process of claiming research and development tax credits.

Businesses of all sizes and types can qualify for the R&D tax credit. Yet the vast majority of credits are claimed by very large manufacturing companies. Why? Because, traditionally, R&D tax studies are complicated and expensive.

At Clarus R+D, our mission is to make R&D tax credits more accessible to SMBs, including pre-revenue startups. As well as expand its value into industries such as software, engineering, biotech, and medtech.

Get money back into your business to hire, innovate, and grow. All for a fraction of the cost of a traditional R&D tax study.