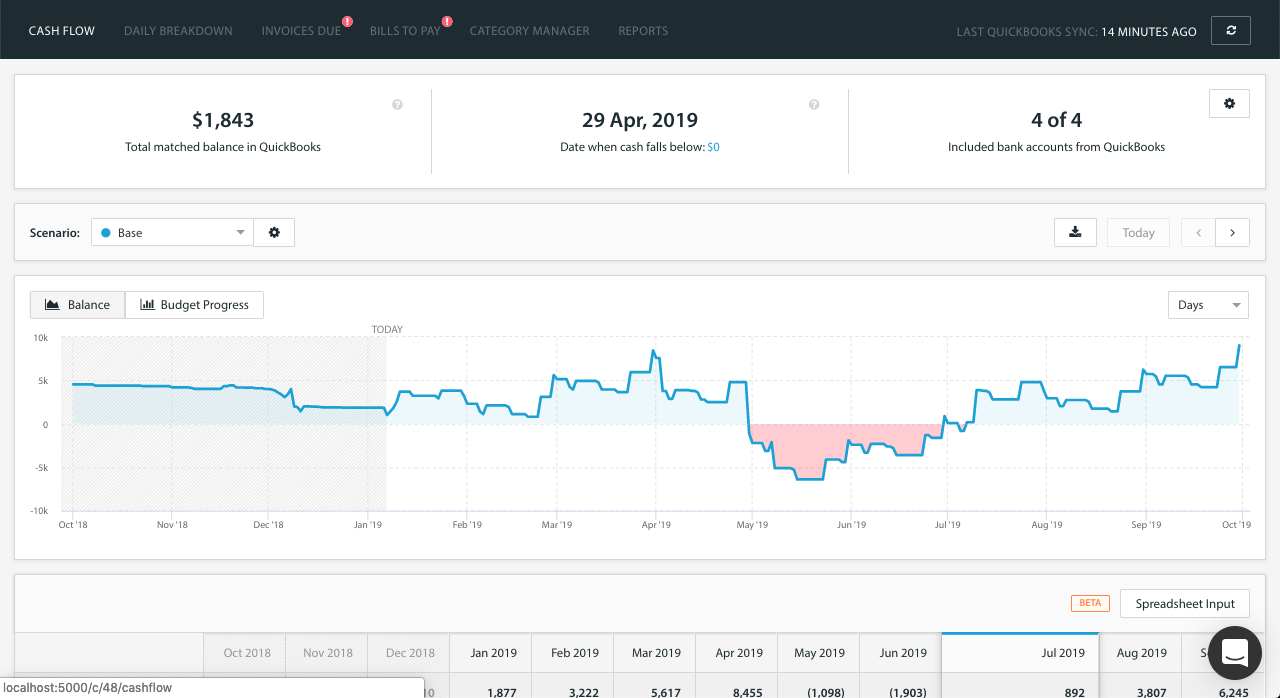

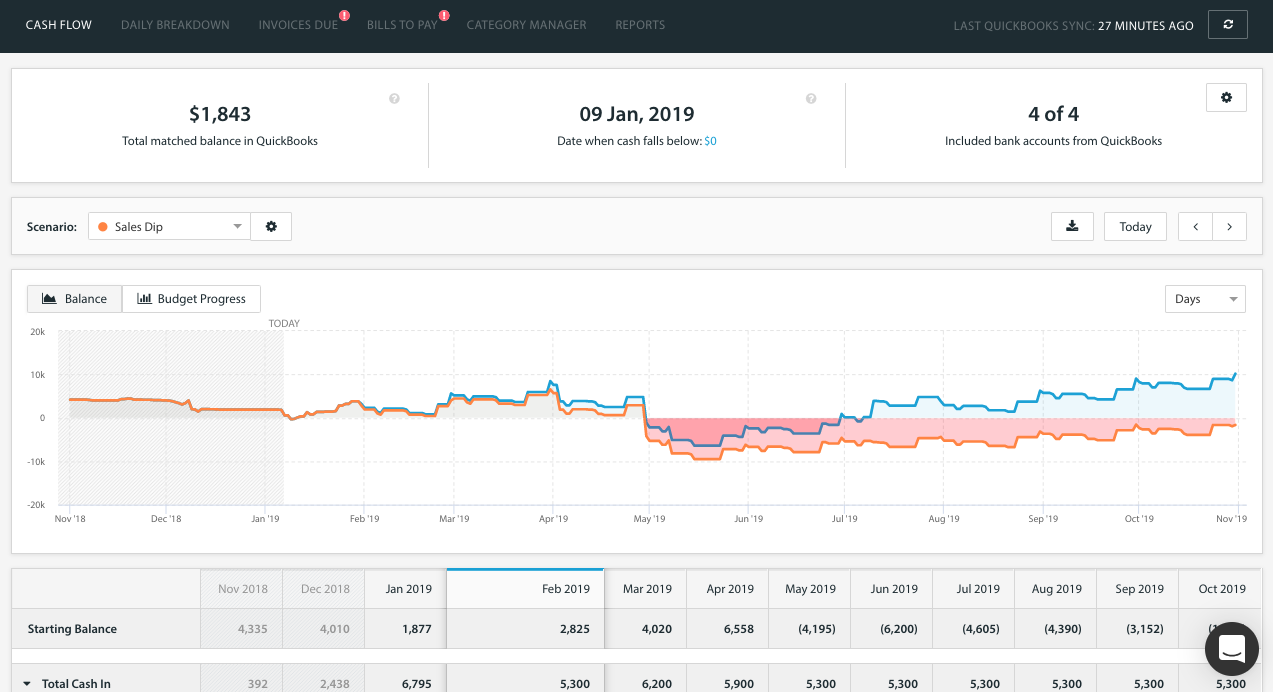

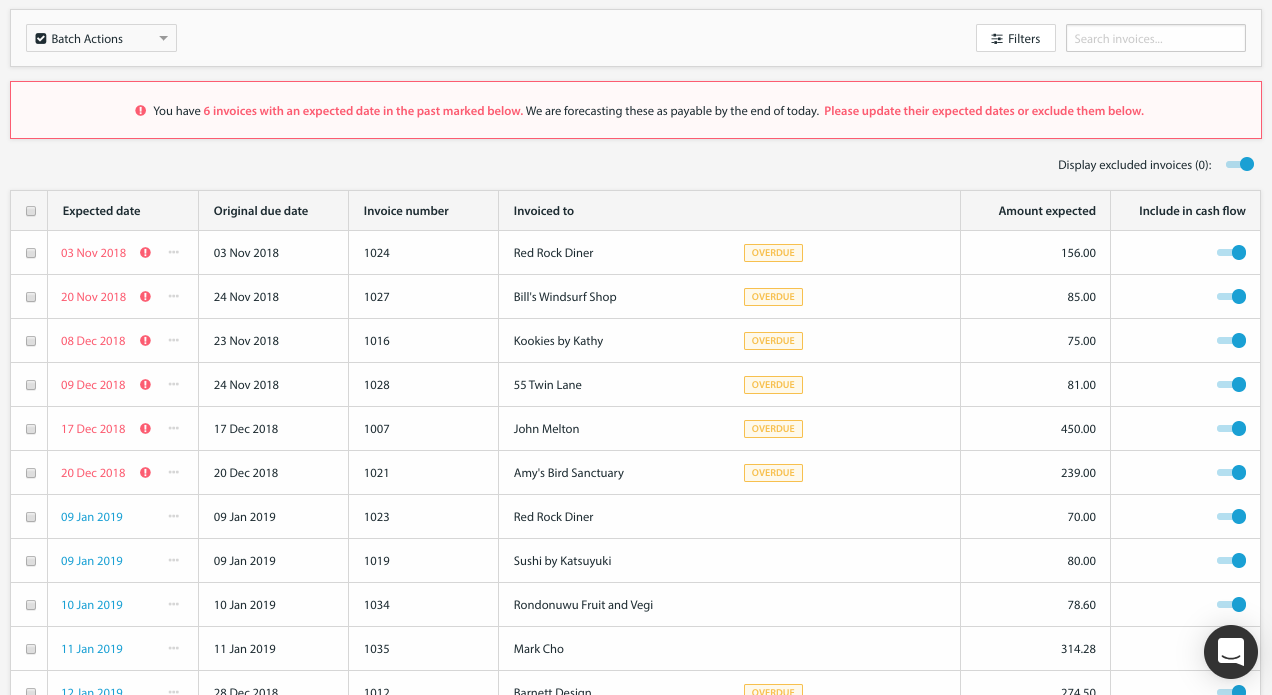

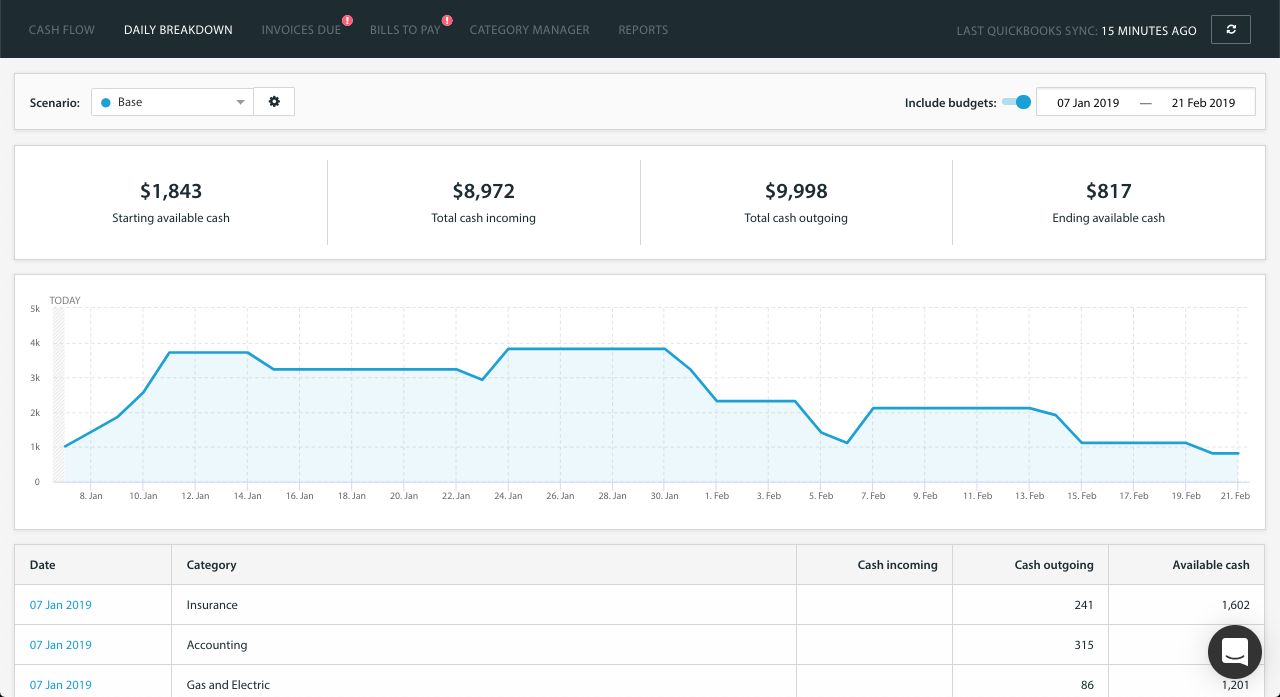

Float is an award-winning cash flow forecasting add-on for businesses using Xero, Quickbooks Online, or FreeAgent. Float creates cash flow forecasts that are more accurate, always up to date and take a fraction of the time to prepare when compared to spreadsheets. Using the direct method of cash flow forecasting (reading all information on bills, invoices and other transactions) we are able to create robust cashflow forecasts that are visual, easy to understand and give a ‘real’ picture of where a business is going in the short to medium term. The accuracy of the data in Float means businesses are alerted to any cash shortages or surpluses well in advance, allowing them to take action. Float makes visual scenario planning a breeze, reducing a task that usually takes hours in a spreadsheet to minutes, businesses can make informed and confident decisions at the click of a button.

Float

Images

Check Software Images

Customer Reviews

Float Reviews

Kendall C.

Advanced user of FloatWhat do you like best?

Float has reduced the time it takes to prepare cashflow schedules down significantly and eliminates the manual errors that can be made by using solutions like spreadsheets. Additionally the ability to create scenarios on top of our baseline budgets is invaluable when it comes to making business decisions.

What do you dislike?

The only one so far is the limitation is not being able to see a consolidated cashflow when you operate more than one associated business entity.

Recommendations to others considering the product:

Make a a regular task to check in on Float and tweak things as you go such as expected payment dates for items that may have run over their due date.

What problems are you solving with the product? What benefits have you realized?

The problem of manual cashflow forecasts always being out of date. As long as the accounting system is up to date, so is Float. And the risk of formula errors in manual spreadsheets.